Hey folks! This month the market did its thing and went down a fair amount, before recovering a bit with one last drop on the last day of the month. Let’s take a look to see how things shook out!

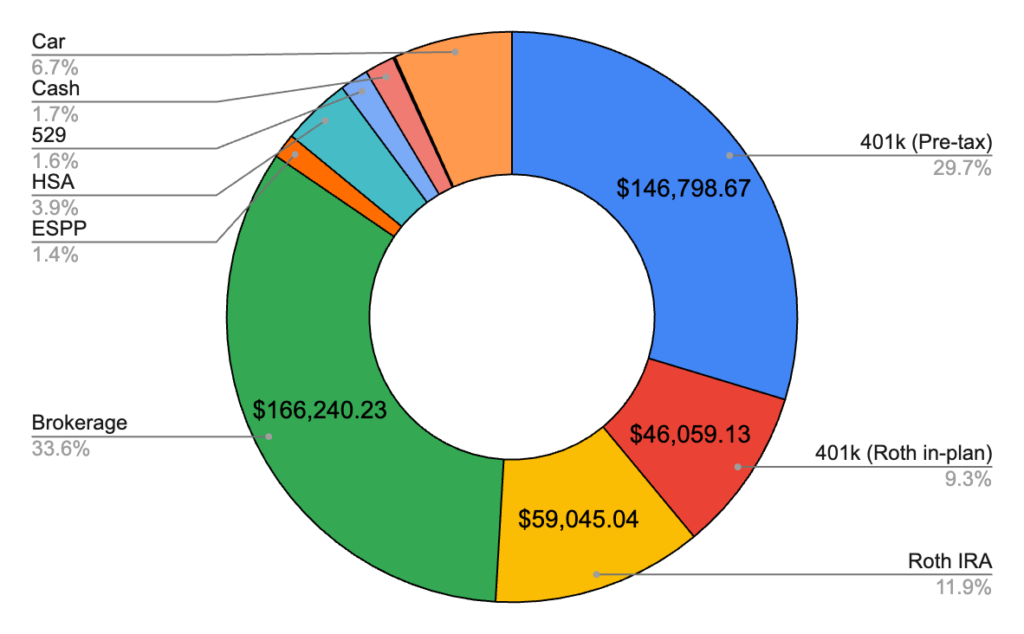

April 2024 – $490,211.79 (+$604.26)

Total Investment Contributions – $19,500

Well the month still managed to be green at least! But after multiple months of seeing unsustainable $30k gains, I definitely expected things to cool down. I was hoping I would end the month finally crossing the $500k mark, and I did, on April 29th, but the drop on the 30th pulled me back below the number. Oh well, hopefully we can get there next month!

Brokerage – $166,240.23 (+$3,034.62)

A small gain here! This month I contributed $9,787.16.

401k Pre-Tax – $146,798.67 (-$3,685.41)

This month I contributed $1,917.00, plus an employer contribution of $437.50, which clearly wasn’t enough to offset the losses!

Roth IRA – $59,045.04 (-$2,515.07)

No contributions just market movement!

401k Roth In-Plan – $46,059.13 (+$2,622.63)

This month I contributed $4,375.00, so I managed to be in the green!

Car – $33,300 (+$300)

KBB value actually went up a little bit! I’ll take it!

HSA – $19,341.41 (-$424.52)

Contributed the usual $345.84, between me and my two employers!

Cash – $8,307.53 (-$1,170.06)

Cash was down a little bit since I went over budget and invested the usual monthly amounts. I’ll get into that more in the budgeting portion below!

529 – $8,009.50 (+$1,331.50)

Put the usual $1,500 in here, split across three 529s.

ESPP – $7,000.04 (+$1,750.01)

Just the usual contribution of $1,750 here. End of June it’ll vest, which I’m looking forward to!

Precious Metals – $479.88 (+$479.88)

I guess I really should’ve been counting this before, but my grandpa used to give me these 1 oz silver coins for Christmas and occasionally birthdays. They’ve sat around for a long time, but I have 18 oz in total so I’m just factoring that into my net worth now. It ain’t much but I’ll take it!

Bonds – $110.36 (+$0.68)

Major gains here on my EE bond.

Federal Taxes Owed – -$4,480.00

The government gave me too much money over the year, so in December 2024 I went back to try to distribute what I owed evenly over these reports.

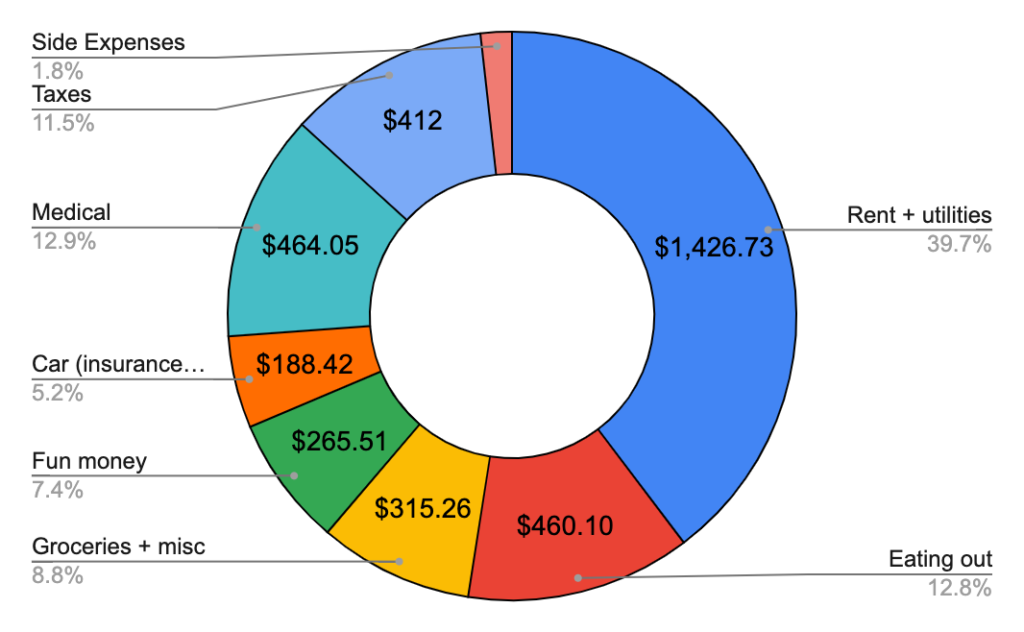

April 2024 Budget – $3,182.01

Total Spending – $3,596.01 (+$414.00)

Had a bit bigger budget this month since I knew I was going to owe taxes and have some medical expenses, and I still blew it by a bit. Though I did do a lot more fun stuff this month, so that certainly contributed.

Rent + Utilities – $1,426.73

I paid a bit more in rent and utilities this month than last but not much I can do here!

Medical – $464.05

Had a couple dentist appointments to deal with, and that cost a fair bit out of pocket. Should be all good on dental stuff for at least six months now!

Eating out – $460.10

Well I did say I’d cut back on this, and I guess I did by about $10. Still way over what I wanted to spend but also was trying to just enjoy. May should be a bit better!

Taxes – $412.00

It was finally time to pay taxes and I ended up owing a little bit. Normally I get a bit back and file in January to get it as early as possible, but when I realized I was going to owe I decided to wait until mid-April! This was taking into account money I got back from the state and money owed to federal taxes.

Groceries + misc expenses – $315.26

Groceries were a bit cheaper this month both because we ordered a little less and my girlfriend was able to chip in some to help as well. Also some misc expenses in here for a car camping trip we took.

Fun money – $265.51

Handful of purchases here, including a weekend at a hotel to go to a baseball game. Overall pretty inline with what I hope to spend in this category.

Car expenses – $188.42

A bit more than last month since we did more traveling, but overall still pretty low.

Side expenses – $63.94

Some miscellaneous expenses for a small side hustle I run. It brought in about $280 this month, which isn’t tons but I’ll take it!

April 2024 Savings Rate – 82.8%

Once again, I calculate my savings rate based off how much I save AFTER taxes are taken out. So this month that math was 3,596.01 / 20,902.74. That means my spending rate was 17.2%, and conversely, my savings rate was 82.8%. About 5% less than last month.

Next month I should finally cross the half-million threshold (but for real this time) and then June should see my savings rate go to unheard of levels (95%+). I’m sure I’ll write more about those plans soon, but until then, stay tuned! Thanks for reading!