Hey folks! Not only did the market recover this month, the S&P 500 hit an all time high before dipping slightly by the end of the month. I hit a pretty major milestone myself, and a record gain in a single month. Let’s get into the numbers!

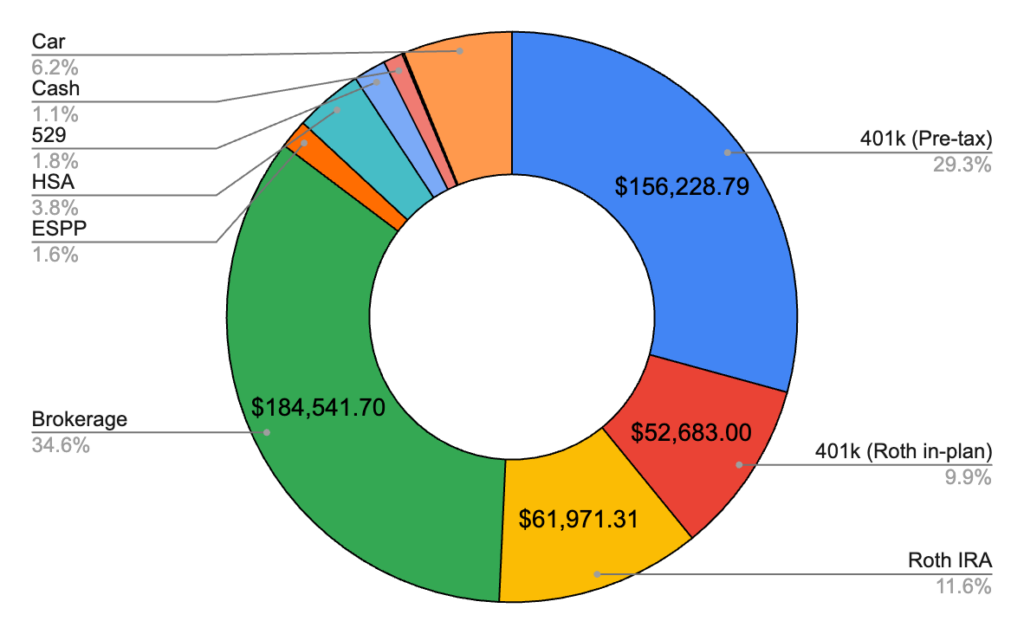

May 2024 – $528,484.22 (+$38,272.43)

Total Investment Contributions – $20,000

Well there it is: I finally passed the $500k mark! And… blew past it by $34k, almost hitting a $40k gain for the month. As I said above, that’s the best gain I’ve seen in a single month. This puts me back on track to my goal of ending the year with $700k, for which I’m definitely gonna need the market to cooperate to pull off. We’ll see! That would be about a $300k gain in a single year, and a 75% gain from where I ended last year. Compounding is crazy! Let’s get into the breakdown by account!

Brokerage – $184,541.70 (+$18,301.47)

Lots of gain here! This month I contributed $10,287.16, $500 more than normal because I was messing around with individual stocks for the first time in three years. As usual, it didn’t go well. Lesson learned, again!

401k Pre-Tax – $156,228.79 (+$9,430.12)

This month I contributed $1,917.00, plus an employer contribution of $437.50, so this is mostly market gains.

Roth IRA – $61,971.31 (+$2,926.27)

Same as last month, no contributions just market movement, but green this time!

401k Roth In-Plan – $52,683.00 (+$6,623.87)

This month I contributed $4,375.00 and we passed $50k in here! In a just a few months it’ll probably pass my Roth IRA that I opened at 18, when I just opened this up last September, which is crazy. The mega backdoor is a hell of a strategy.

Car – $32,993.00 (-$307.00)

Slight drop in value on the Tesla, but staying pretty steady. With how much cheaper FSD has gotten, I’m surprised it hasn’t dropped more, but I’ll take it.

HSA – $20,549.42 (+$1,208.01)

As usual, contributed $345.84, between me and my two employers! Finally passed the investment threshold at my newest HSA, so now getting some gains there.

529 – $9,804.46 (+$1,794.96)

Put the usual $1,500 in here, split across three 529s, with a decent gain on top!

ESPP – $8,750.06 (+$1,750.02)

Put $1,750 in here again this month, and now we’re only a month away from vesting, where I’ll get some instant gains due to the discount. So I guess brokerage should have a good pop with this money moving over, and this account will reset to $0!

Cash – $5,901.72 (-$2,405.81)

I was totally over budget on top of the extra $500 I threw into my brokerage. I’ll break that down below and get into what happened!

Precious Metals – $550.08 (+$70.20)

Silver was up this month, I guess! I’ll take it!

Bonds – $110.68 (+$0.32)

And as always, the lynchpin of this whole operation, my single series EE bond chugs endlessly up and to the right. What would I do without you?

Federal Taxes Owed – -$5,600.00

The government gave me too much money over the year, so in December 2024 I went back to try to distribute what I owed evenly over these reports.

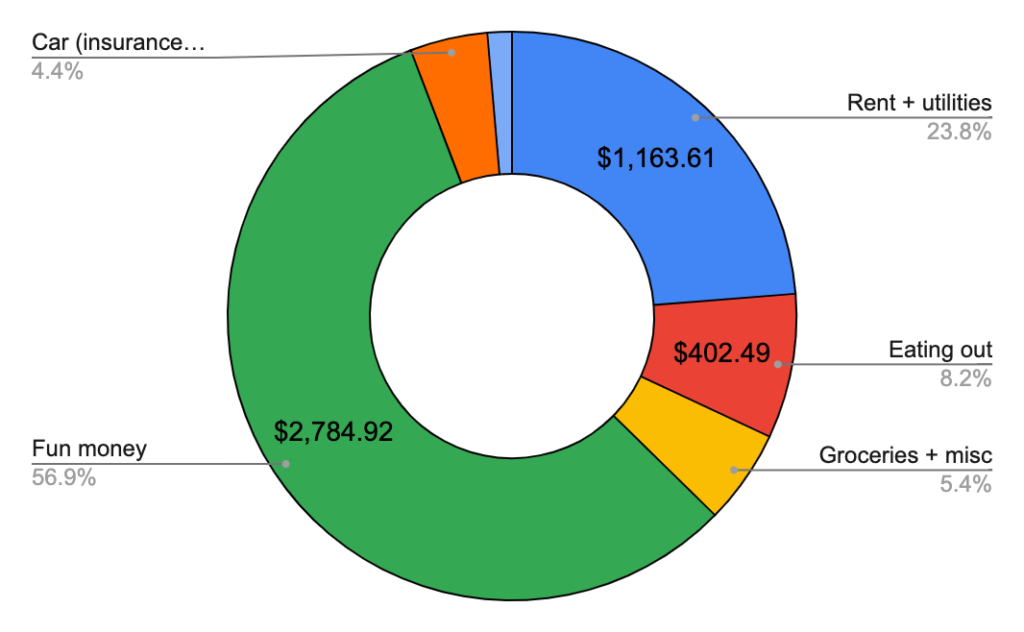

May 2024 Budget – $2,450.00

Total Spending – $4,898.23 (+$2,448.23)

Whew, that was a big spending month! Almost doubled the budget! To be fair though, I knew I was going to have some expenses this month that are technically fun money but will end up being a huge savings in the long run. I alluded to that a bit on last month’s post now but I’ll reveal my hand: my plan is, starting in June, I’m going to be traveling the country and car camping in my Tesla. That meant getting a solar panel, decent sized battery, a Starlink panel and the accompanying monthly service fee, along with a small mattress and other essentials. The June report won’t show the rent savings since our lease goes through June, but in July we’ll see rent drop off the sheet altogether! As for why: I figure if I’m going to have remote jobs I might as well take advantage. I’ve always wanted to go on a cross country road trip, and figure I shouldn’t have to wait until I’m retired to do it. And my girlfriend is going to another state for ten weeks of job training so it gives me a chance to try it out and see if I enjoy the lifestyle! I’ll write more about that soon, both before and after actually hitting the road, but I’m super excited about it! Anyways, let’s get on to breaking this down!

Fun money – $2,784.92

Woah, this is the big one! A lot of it I already covered above, but this was a lot of Amazon purchases and then acquiring a Starlink. Wasn’t a lot that could be done to bring this down, and it will certainly be lower again in June!

Rent + Utilities – $1,163.61

The amount I paid for this went down a bit this month since my girlfriend got her new job and was able to pay a bit more! Just one more month of this and my biggest expense goes away!

Eating out – $402.49

Ended up down a bit from last month without even trying! And that’s with at least seven or eight Chipotle orders!

Groceries + misc expenses – $263.43

Not too much for groceries and random expenses this month. I was out of town part of the month and we did a bit less grocery ordering than normal!

Car expenses – $215.86

Took a long road trip this month so a bit higher than last month, but nothing crazy here!

Side expenses – $67.92

Expenses from the side hustle here again, but this will be dropping off next month since I’m pausing things to travel. I’ll pick it back up again once I’m done!

May 2024 Savings Rate – 77.2%

Once again, I calculate my savings rate based off how much I save AFTER taxes are taken out. So this month that math was 4,898.23 / 21,509.73. That means my spending rate was 22.8%, and conversely, my savings rate was 77.2%. Another 5% drop from last month!

Next month my savings rate should get closer to 90% and finally cross the threshold into 95% in July! Aiming for $600k by the end of August, fingers crossed! Thanks for reading!