Hey folks! A lot of upward movement in the market this month. The S&P 500 hit 5,500 a couple times, and even hit it’s mid-day record on the last trading day of June, before falling slightly to settle at about 5,460. So about 3.5% up this month, which was quite helpful along with my own contributions!

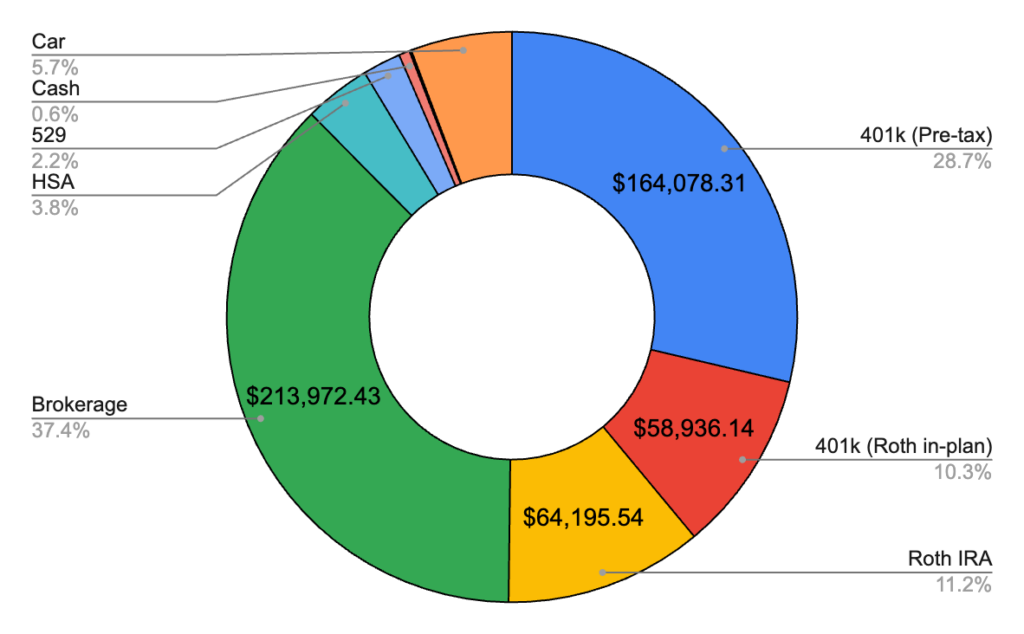

June 2024 – $565,519.32 (+$37,035.10)

Total Investment Contributions – $21,000

Another nearly $40k month, and just shy of the record month I had last month! I thought I was gonna have it when I saw the market at 5520 mid-day on that last trading day, but alas, it wasn’t meant to be. And you can’t really complain about gains like these! Now that we’re halfway through the year, it’s worth reflecting that since ending last year with $400,918.75, I’m up a whopping $170,902.90 just this year, which is a more than $28k gain per month on average! I’ve never had a year with that much gain, let alone in half a year! Guess we’ll see what the rest of the year brings! Let’s get into the breakdown by account!

Brokerage – $213,972.43 (+$29,430.73)

Wow, that’s some major gains! Well, there are a couple reasons for it. This month I contributed $10,537.16, $750 more than usual, but will be standard going forward. This is my last month with having to pay rent, so I allocated some extra money here. The other reason is that my ESPP money vested for the first half of the year! I get a 15% discount, but unfortunately was on the “worse” end of the deal where the stock price was lower at the end of the six months, so it’s about a 17% gain on my money (so my $10,500 became about $12,300). And worse I have to hold onto it for a while, but I’ll sell it for index funds as soon as I’m able. Guess we’ll hope my company does well!

401k Pre-Tax – $164,078.31 (+$7,849.52)

This month I contributed $1,917.00, plus an employer contribution of $437.50, so this is mostly market gains as usual.

Roth IRA – $64,195.54 (+$2,224.23)

As always, no more contributions here for the year, but thankfully this month still going up!

401k Roth In-Plan – $58,936.14 (+$6,253.14)

This month I contributed the usual $4,375.00. Getting ever closer to the day this passes the amount in my Roth IRA I’ve had since I was 18. Together though, I’m now at $123k in Roth accounts. Honestly, with $161k in pre-tax and a much lower ability to contribute, I bet it won’t be long before Roth combined passes pre-tax! Crazy!

Car – $32,895.00 (-$98.00)

Another surprisingly low drop for my Tesla. I’ll take it!

HSA – $21,608.06 (+$1,058.64)

As usual, contributed $345.84, between me and my two employers! Annoyingly, Optum has decided to stop allowing you to connect to aggregation apps, so I have to start doing it manually. Oh well. I hope that’s not a trend with other accounts as well!

529 – $12,403.42 (+$2,598.96)

Bumped my contribution here to $2,250, up $750, to allocate the rest of the extra money I’ll have without paying rent. I intend to keep contributing something here even in retirement, at least a little.

Cash – $3,509.34 (-$2,392.38)

Over budget as always! Should see a nice drop here next month too because an old 401k that was basically sitting making nothing is finally getting rolled over to my investment accounts! (Edit: I later decided that old 401k should never have been counted as cash, so all my reports were edited in December 2024 to re-characterize it as part of my pre-tax 401k) I’m comfortable with a smaller cash position since I have plenty of money to get out elsewhere if needed. And I can easily cut back on investing in any given month to shore up cash.

Precious Metals – $529.74 (-$20.34)

Silver was down! At some point I should just sell my 18oz off.

Bonds – $111.32 (+$0.64)

My single series EE bond making huge moves here again. I can almost buy a dollar menu item with those gains!

ESPP – $0.00 (-$8,750.06)

It’s all gone! As I mentioned above, my ESPP vested this month. So I put $1,750 in here this month, getting to $10,500, and then moved over to my brokerage account with a boost from the 15% discount. And now we’ll start next month building it up again for the end of the year! Lets hope this period the stock goes up!

Federal Taxes Owed – -$6,720.00

The government gave me too much money over the year, so in December 2024 I went back to try to distribute what I owed evenly over these reports.

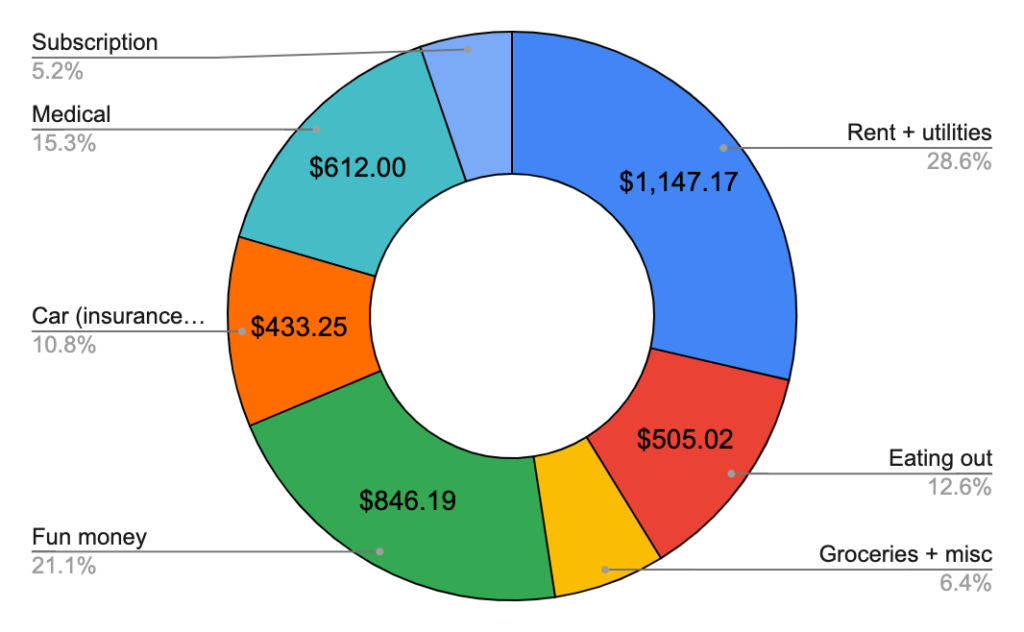

June 2024 Budget – $2,174.20

Total Spending – $4,008.05 (+$1,833.85)

Alright, a bit lower than last month but definitely still over budget! I did get a start this month on traveling the country in my Tesla, and I ended up realizing I needed a few more things. So while visiting my girlfriend, who’s currently doing her job training, I was able to get an electric cooler, some hiking boots, and a few other odds and ends. And yeah, we spent a bit on eating out again. Next month, we’ll see what happens, but without rent on the budget, my savings rate will definitely improve! It’s been so great to travel and see National Parks and National Forests all while paying nothing and still being able to do my jobs without issue. Between seeing family and seeing my girlfriend I only did about a week of traveling, but July will be a full month of it. Super excited for that!

Rent + Utilities – $1,147.17

This is it, the last month of paying this! Excited to see what things look like next month when this drops off!

Fun money – $846.19

This was mostly the aforementioned purchases that I got to make my car travels better. I got an annual pass to the National Parks for $80, so now I can see them all for free! I also got a concert ticket for later in the year to see with a friend, and then some various other fun stuff while I was home with family. Definitely lower than last month!

Car expenses – $433.25

Not too surprised to see this go up! I drove all the way to see family, up through multiple states seeing National Parks, and then to my girlfriend who was a couple more states away. I did find some free chargers for my Tesla, but a lot of this was me having to use superchargers. Next month I’m going to see what I can do to get more free charging where it’s possible.

Medical – $612.00

Got a years worth of contacts and paid for a couple therapy sessions. Not much I could do to keep those costs down!

Eating out – $505.02

Surprisingly not too bad this month all things considered. Definitely was helped by a Chipotle giftcard that I did not count against the budget!

Groceries + misc expenses – $254.72

Being home with family for half the month kept this down quite a bit. Next month when I’m on my own though, I expect it to be fairly similar, but we’ll see!

Subscriptions – $209.70

Had a few things here. Biggest is the Starlink subscription, which going forward my job will pay for part of since it’ll be my main internet subscription. Also started a Planet Fitness membership. Otherwise just a couple small odds and ends.

June 2024 Savings Rate – 81.3%

As always, I calculate my savings rate based off how much I save AFTER taxes are taken out. So this month that math was 4,008.05 / 21,439.98. I had some money come back I’d loaned to someone, and some early birthday money add an extra $800 on top of what I got from my jobs. That means my spending rate was 18.7%, and conversely, my savings rate was 81.3%. We’re finally trending in the right direction!

Next month we finally get to see what happens when you have no rent! Over 90% is practically guaranteed, but I’m aiming for 95%+ (if I follow my budget to a tee, which I never do, it’ll be 96.6%!). Still going to be enjoying and traveling, but on a budget! Still aiming for $600k by the end of August, and even if we have a couple slightly down months, we’ll be there! Thanks for reading!