Hey folks! Pretty wild month for the market (and for me personally, I’ll get to that a bit below), with the first half of the month seeing a surge all the way to the high 5,600s, before crashing back down to 5,399, and then having a good recovery on the last day of the month to 5,522. So up about 1.1% this month, which I’ll take considering how dire things were looking a week ago!

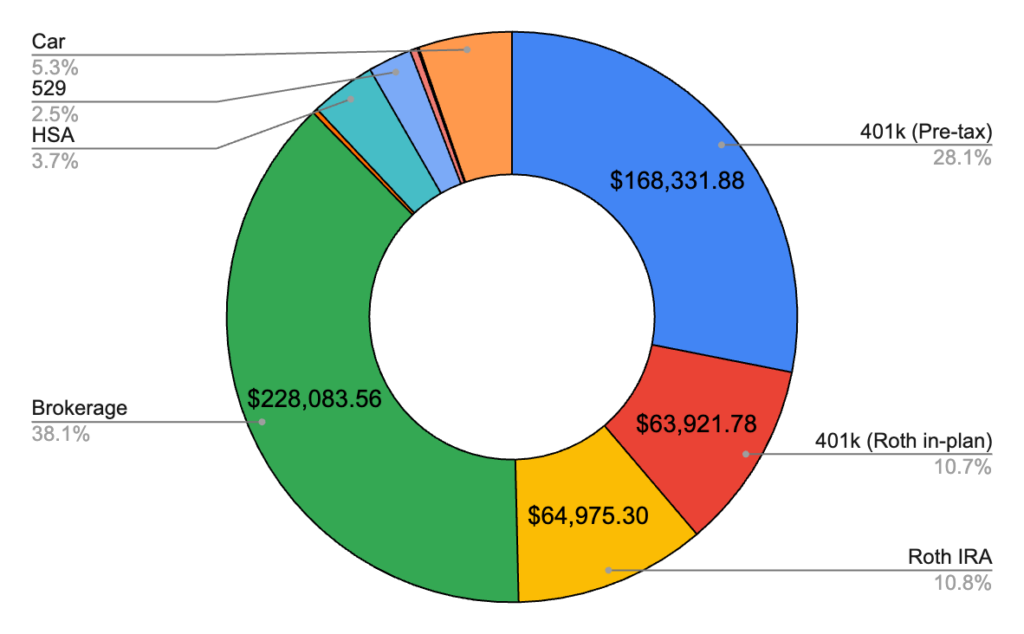

July 2024 – $591,050.73 (+$25,531.41)

Total Investment Contributions – $21,000

Not bad, especially considering I had more expenses than I expected this month! Most of the gain this month was just my contributions but the market did help with that 1% boost! I came so close to hitting 600k, which is crazy since it was only about three months ago that I hit 500k. Things really are moving quickly, but I know they can also go the other way on dime, as the middle of this month showed. My goal is still to hit 700k at the end of the year, and I think that’s achievable even with a flat market at this point, so I guess we’ll see what happens! Let’s get into the all important breakdown by account!

Brokerage – $228,083.56 (+$14,111.13)

This month I contributed the new usual $10,537.16. Otherwise it was just a bit of market movement, and the first with my invested ESPP money, which at least for this month, beat the market by a lot! We’ll see if that trend continues!

401k Pre-Tax – $168,331.88 (+$4,253.57)

This month I contributed $1,917.00, plus an employer contribution of $437.50. Crazy to think within the next year this bucket should be up to about 200k!

Roth IRA – $64,975.30 (+$779.76)

As always, no more contributions here for the year, but still some small upward movement!

401k Roth In-Plan – $63,921.78 (+$4,985.64)

This month I contributed the usual $4,375.00. Next month will finally be the month where this account passes my Roth IRA! I’m almost at a year’s worth of mega backdoor contributions, and it’s just amazing how fast things move when you take full advantage of it. We’ll see where it lands by the end of the year!

Car – $31,717.00 (-$1,178.00)

Ouch! A bit of a big drop here, but that’s how it goes!

HSA – $22,180.65 (+$572.59)

As usual I contributed $345.84, between me and my two employers! And then some small gains from the market.

529 – $14,797.50 (+$2,394.08)

Did my now usual contribution of $2,250, and then saw some very small market gains. Slow and steady, this is getting built up.

Cash – $2,495.23 (-$1,014.11)

Small drop here! The old 401k I was trying to roll over hit a snag and I have some paperwork to deal with to get it moving again, so maybe we’ll see that money move in a future month. (Edit: I later decided that old 401k should never have been counted as cash, so all my reports were edited in December 2024 to re-characterize it as part of my pre-tax 401k) Otherwise this was just me being over budget, which we’ll get to below!

ESPP – $1,750.01 (+$1,750.01)

Back to building this up again! And so far, we’re on the better end where the stock is going up! Guess we’ll see where that lands by the end of the year, but that’s a ways a way yet!

Precious Metals – $526.14 (-$3.60)

Just a small drop here! Will sell it all someday.

Bonds – $111.68 (+$0.36)

Major gains.

Federal Taxes Owed – -$8,960.00

The government gave me too much money over the year, so in December 2024 I went back to try to distribute what I owed evenly over these reports.

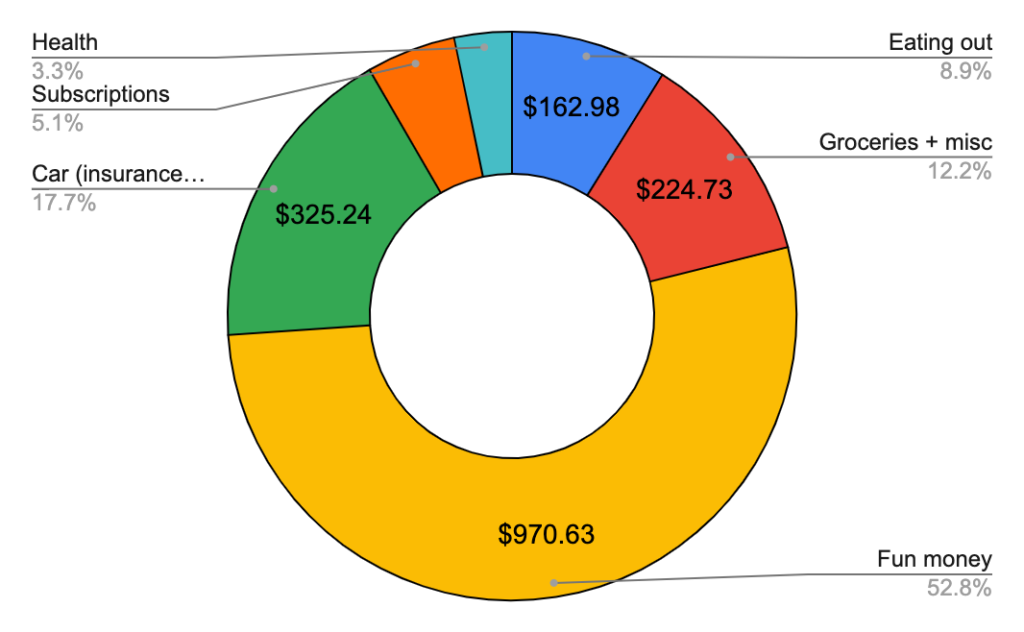

July 2024 Budget – $742.02

Total Spending – $1,836.98 (+$1,094.96)

Well, to put it mildly, July went a lot different than I expected. The plan was to travel the eastern part of the country, continuing to see National Parks and some of the states I’ve never been to, with a small budget and no rent to pay. I made it about two days into the month and started experiencing some stomach pain that ended up becoming a whole big medical problem, including several hotel stays, two ER visits, multiple nights in those hospitals and surgery. I’ll spare you the fun details beyond that and I’m doing a lot better now. Next month the budget will be blown up with medical bills, but none came this month yet so that helped out this month’s budget! Let’s get into the details!

Fun money – $970.63

This is really where things blew up. I’m not sure that staying in hotels when you feel sick is “fun” money, but this is sorta the catch all. Honestly without the money I spent on hotels, the budget would’ve been a lot closer to the plan.

Car expenses – $325.24

Nothing too surprising here. I had been doing good with free chargers earlier in the month but had to use a lot of superchargers to get where I was going mid-month. There were also a bunch of tolls to pay. Fun stuff!

Groceries + misc expenses – $224.73

I had some orders to my hotel room and then bought some more groceries once I was home, along with some other small expenses. Feels pretty reasonable.

Eating out – $162.98

Much better than normal honestly, helped by being stuck in the hospital for a third of the month!

Subscriptions – $93.38

I was able to pause my Starlink since I wasn’t really needing it this month, but had gym membership and few other things come out here.

Medical – $60.02

Just a few small things like prescriptions here, next month will be the doozy.

July 2024 Savings Rate – 91.1%

As always, I calculate my savings rate based off how much I save AFTER taxes are taken out. So this month that math was 1,836.98 / 20,709.22. That means my spending rate was 8.9%, and conversely, my savings rate was 91.1%. Finally over 90%, woo hoo! After a rough month like this, I’ll take that win.

Next month I’ll definitely drop below 90% again to pay those medical bills, but we’ll try to get back above 90% in September! I’m not sure exactly when I’ll be hitting the road again, but hopefully it’s soon! Thanks for reading!