Hey folks! Well, August started off with a bang! After seeing major losses across the entire stock market, the major indexes not only recovered, but got near or at record highs. The S&P 500 ended up about 2.3% up for the month, and is only 0.3% down from the all time high. As I figured in July, there were quite a few medical bills to pay, and there’ll be more still in September. Let’s get into the numbers!

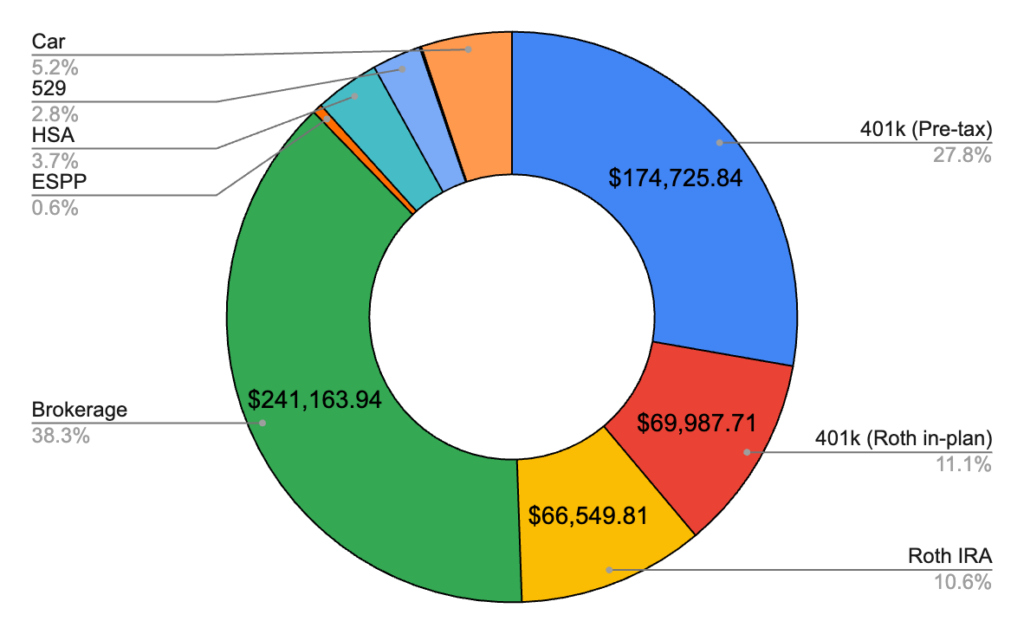

August 2024 – $619,185.79 (+$28,135.06)

Total Investment Contributions – $21,000

Another nearly 30k this month, and I finally passed $600k! Hopefully I got enough of a lead that it’s my last time passing it, unlike mid-July and end of July when I would hit it temporarily and then watch the markets go down! I’m in a good position now to hit $700k at the end of the year, even with some market losses between now and then. We’ll just have to see what happens! Let’s get into the breakdown by account!

Brokerage – $241,163.94 (+$13,080.38)

This month I contributed the usual $10,537.16. The trend of my ESPP money beating the market was broken nearly immediately as the month started, and ended up down double digits. Oh well! This account is nearly at $250k which is crazy progress in just one year, when it was at about $100k!

401k Pre-Tax – $174,725.84 (+$6,393.96)

This month I contributed $1,917.00, plus an employer contribution of $437.50. We’re getting ever closer to a $200k balance here!

401k Roth In-Plan – $69,987.71 (+$6,065.93)

This month I contributed the usual $4,375.00. And finally, it happened! After just shy of a year of maxing out my mega backdoor contributions, it’s managed to pass my Roth IRA that I opened at 18, seven years ago. I can’t believe this loophole exists, but I’ll continue to take advantage of it as long as I can!

Roth IRA – $66,549.81 (+$1,574.51)

No contributions here, just growth! Before long it’ll be time to get another $7k in here, but it won’t be enough to catch up to my other Roth account!

Car – $32,446.00 (+$729.00)

Oddly, a sizable gain here, especially considering I remembered to update KBB to accurately reflect the current milage. I’ll take it!

HSA – $23,035.72 (+$855.07)

I contributed $345.84, between me and my two employers! I’m getting close to the limit on one of the HSAs that’s needed for the new money to be invested, which will be nice. So annoying to have to wait to get a certain amount in there! Luckily, most of this money is in one account and fully invested!

529 – $17,424.48 (+$2,626.98)

This month I contributed $2,250, and the market gave a little boost! Should be closer to 30k in here by the end of the year!

ESPP – $3,500.03 (+$1,750.02)

Continuing to build up this again for a stock purchase at the end of the year. So far it’s not doing super great, but we’ll see what happens!

Precious Metals – $526.50 (+$0.36)

Guess silver stayed pretty flat this month!

Bonds – $112.00 (+$0.32)

Bringing up the rear, my single Series EE bond brought in a whopping 32 cents.

Cash – $-1,354.17 (-$3,849.40)

Big drop here! That’s because of the medical bills which I’ll get into below. I opted to invest my usual amount which obviously put me at a deficit. Next month I’ll have to drop the investment contributions enough to shore this up a little bit.

Federal Taxes Owed – -$8,960.00

The government gave me too much money over the year, so in December 2024 I went back to try to distribute what I owed evenly over these reports.

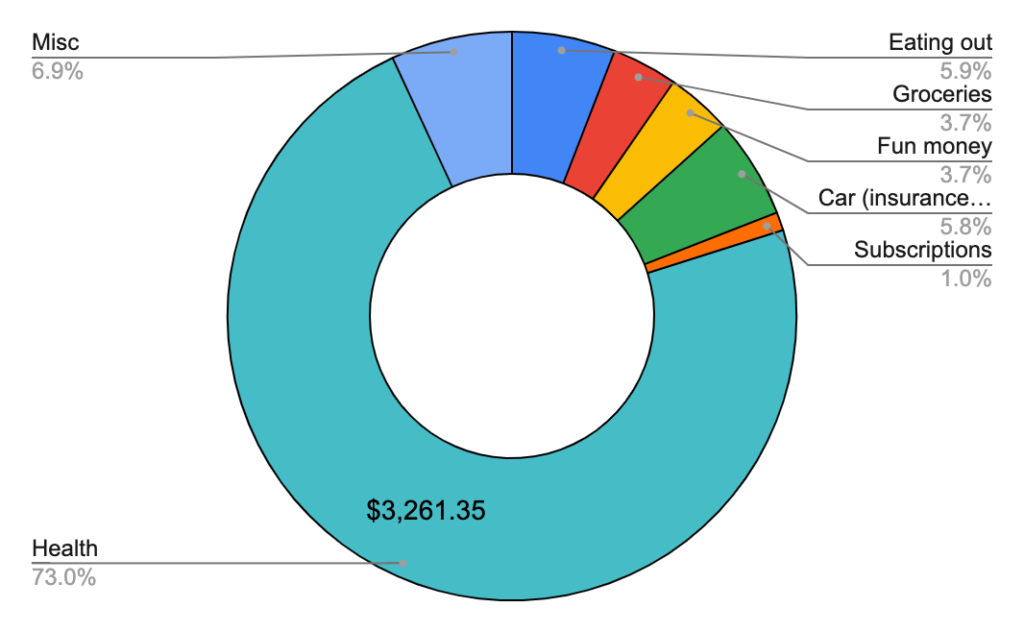

August 2024 Total Spending – $4,468.03

August was a much calmer month than last, thankfully! It was pretty much just a month of recovery for me, and my expenses, besides medical bills, were fairly low. I’m definitely feeling a lot better now, a month out from all the craziness. Let’s get into the details!

Health – $3,261.35

And here’s the big one! Turns out being in the hospital for more than a week gets expensive! This is roughly half of the bills I expect to pay, so I’m thinking the rest will come in next month. Is what it is, but I made the best of it by making sure I get some travel miles for it with some good sign up bonuses.

Misc expenses – $308.13

Decided to split this into its own category so I have a clearer picture of my grocery costs. This was a just a few odd things, half of which was paying for some utilities at my old apartment they billed after the fact.

Eating out – $262.55

Not too bad, I did get some meals with friends and get some other food out a handful of times!

Car expenses – $257.21

A good bit of this was some tolls I needed to pay from my travels, but otherwise it was the usual insurance and car charging!

Groceries – $167.08

A bit of a light month for groceries, but spent a good amount towards the end of the month to get stocked up!

Fun money – $165.43

Mostly a plane ticket here, otherwise a pretty light month!

Subscriptions – $46.28

Just the usual gym membership and few other things here!

August 2024 Savings Rate – 78.3%

As always, I calculate my savings rate based off how much I save AFTER taxes are taken out. So this month that math was 4,468.03 / 20,622.02. That means my spending rate was 21.7%, and conversely, my savings rate was 78.3%. As I figured, we’re down a bit this month, but all things considered, not bad!

I figure next month will be similar to this one just because I still have more medical bills to pay. I’ll just keep doing the best I can! Thanks for reading!