Note: This is a repost from an old blog of mine, remixed with the graphs, headings ordering, and stylizations I normally do, but otherwise the text is unchanged. Hope you enjoy taking a look back at where this all began! -CJ

Hello readers! For those who are new, these are my monthly posts where I share all the details of my progress on my FIRE journey!

July was moving month for me, but thankfully I only have a couple carloads of stuff so far in life! Also July had another special day, my 21st birthday! My goal was to have $60k saved by that date, and I did it! Woo hoo! Had a fun night with free drinks, what’s not to like?

The market was really good this month, even better than June, which continues to be a surprise. The S&P 500 is about 3 or so percentage points from its pre-Corona high. It’s hard not to feel like things are going to come crashing down for the market, but so far it really isn’t.

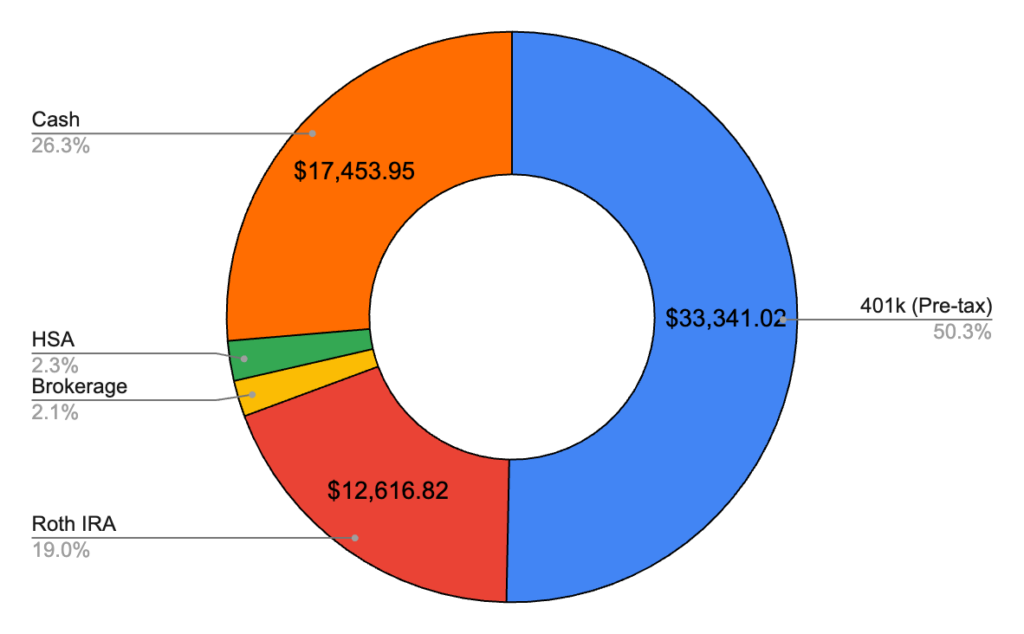

July 2020 – $66,270.70 (+$6,512.84)

Solid increase! Had to pay some pricey medical bills so it’s nice to see the market helped me out this month. Looking on track for my next goal which is $100k by next May. Initially, I was aiming that goal for my birthday next July but more recently moved it up. My projections show I actually might hit it considerably earlier than May but it just depends on if the market bottoms out or something else crazy. Feeling good about my progress though!

401k – $33,341.02 (+$1,621.78)

Woah, that’s a jump! By my math, a bit over 5% increase over last month and no contributions here. Not sure if I mentioned it in previous reports, by my current place of employment doesn’t allow employees to start a 401k until working there for 6 months, which will be December. So, I’m unfortunately not going to max out my 401k this year, but I’ll do the best I can.

Cash – $17,453.95 (+$2,122.68)

Solid increase here considering I moved $2,000 into Fidelity. I’ve been thinking lately that it almost feels like I have too much cash in savings when you consider my monthly expenses, which are usually at or below $1,000. I’m way over a year of expenses, and the usual recommendation is 6 months or so. I’m just sorta nervous putting a large sum into brokerage or maxing my Roth IRA all at once. Something to think about this month, because it’s only going to become larger each month until I invest more than I’m earning.

Roth IRA – $12,616.82 (+$1,647.86)

I ended up going with my plan of putting a thousand in every month for the rest of the year, just so I’m not putting in way too much at once. The rest is all market movement.

HSA – $1,500.00 (+$0)

No movement here but made good progress with getting things settled with my new address, which was a pain. Should be making pre-tax contributions here in August!

Brokerage – $1,358.91 (+$1,119.71)

Opened up a brokerage account with Fidelity (put $1,000 in) so that and Robinhood are pooled together now. The brokerage account is all S&P 500, Robinhood is still in SPCE. SPCE went up almost $100 this month which is encouraging. Hopefully I break even soon!

Hope you enjoyed this net worth report! Happy saving!