Note: This is a repost from an old blog of mine, remixed with the graphs, headings ordering, and stylizations I normally do, but otherwise the text is unchanged. Hope you enjoy taking a look back at where this all began! -CJ

Hello readers! For those who are new, these are my monthly posts where I share all the details of my progress on my FIRE journey!

August was a crazy month in more ways than one. First of all, the S&P 500 soared to an all time record right as the month was closing out, something I wondered if we’d see last month since we were only about 3% away from the record. And it really shows no signs of stopping, somehow! Still waiting for the other shoe to drop.

Also had a grad school class end and a couple more start which means I had to shell out the big bucks once again. But hey, maybe it’ll pay off later on!

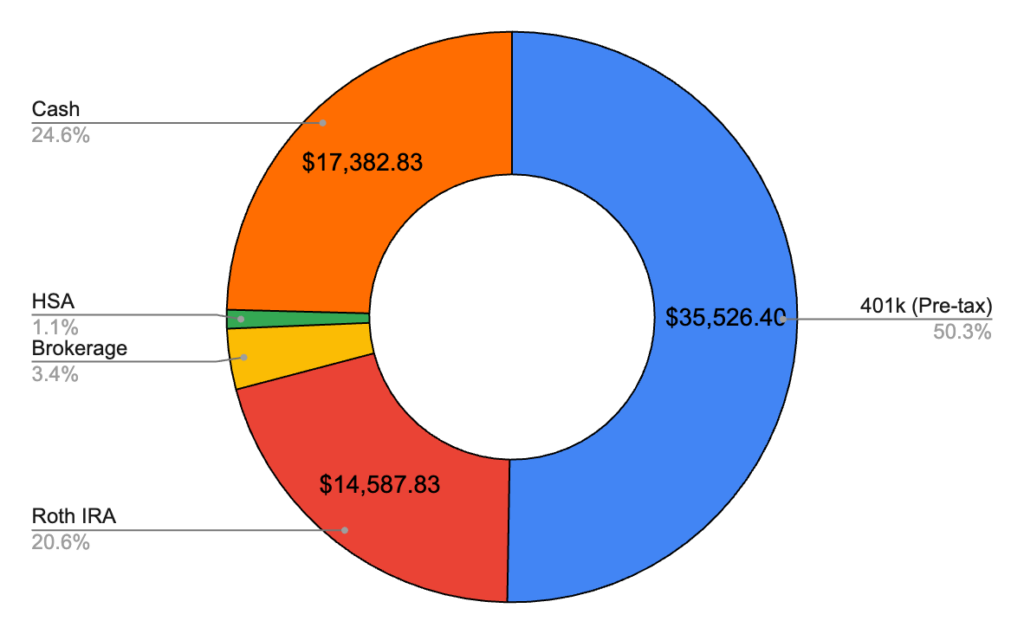

August 2020 – $70,680.64 (+$4,409.94)

Not a bad increase at all! After officially crossing $60k by the end of July, I made the cutoff for passing $70k by the end of this month! I spoke last month about my goal to reach $100k being moved up from July to May. Well, this month I decided to move that up to the even more ridiculously ambitious month of January. I might miss, but I didn’t want to set goals that I knew I was going to reach without having to put in extra effort. Moving to January makes me sweat a little bit and will force me to do better about saving and finding other sources of income, an all around win!

401k – $35,526.40 (+$2,185.38)

Just market movement as always here. And just when I thought I wouldn’t see a jump like July again! As always, 99% of my money is invested in S&P 500 index funds, which I continue to recommend over individual stocks. Total stock market index funds are great too, just don’t try to beat the market!

Cash – $17,382.83 (-$71.12)

Finally a month where my cash on hand went down! This was expected, since I had to pay $2,000 for grad school tuition, put $2,000 in Fidelity, and then had rent and the usual expenses. Well, and I bought some AirPods, but hey, I needed headphones! I imagine the occasional Taco Bell runs didn’t help either but September should be better!

Roth IRA – $14,587.83 (+$1,971.01)

Put $1,000 in and the market almost matched me! Continuing on putting $1,000 in every month until maxing out at the end of the year and now I finally set up automatic deposits!

Brokerage – $2,433.58 (+$1,074.67)

Mostly movement from my contribution here. Some gains in the S&P outdid the losses on SPCE.

HSA – $750.00 (-$750.00)

Oh god, a 50% drop! No need for panic though. All that happened is I misunderstood my company’s HSA policy and assumed it was similar to my previous employer, and that the annual $1,000 would come in a lump sum. Turns out it’s in installments, of which I got the first $250. So the rest of the money will come but for accuracy’s sake this is what I have between my two HSA accounts currently.

Hope you enjoyed this net worth report! Happy saving!