Note: This is a repost from an old blog of mine, remixed with the graphs, headings ordering, and stylizations I normally do, but otherwise the text is unchanged. Hope you enjoy taking a look back at where this all began! -CJ

Hello readers! For those who are new, these are my monthly posts where I share all the details of my progress on my FIRE journey!

September was a pretty solid month for me personally, but not so much for the markets. The first couple days were great and then it was really all downhill from there, with a little recovery towards the end. We’ll see what happens in October, but I’m not too worried about it!

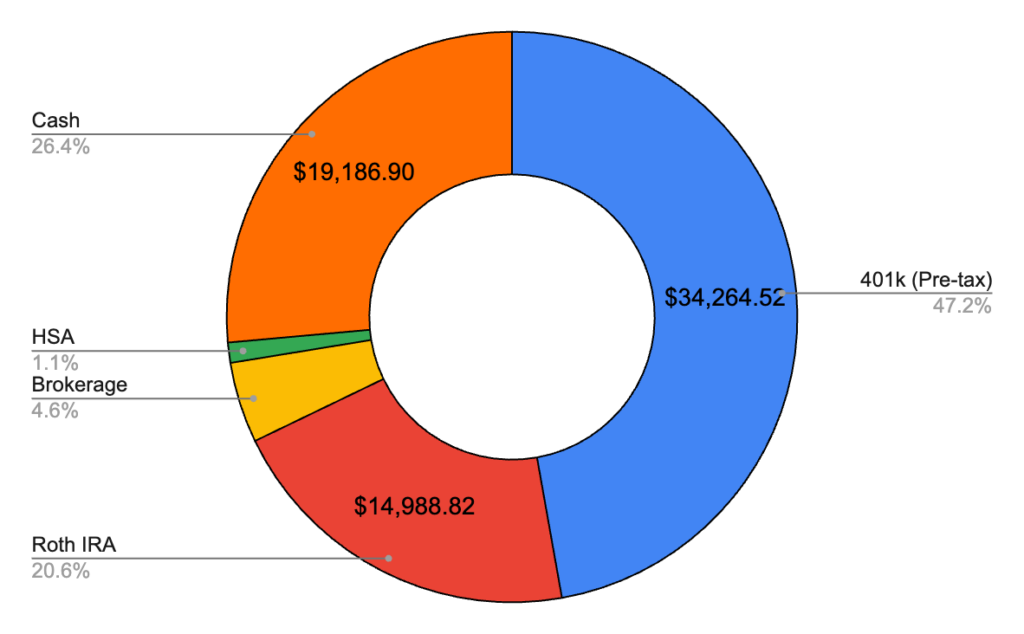

September 2020 – $72,596.90 (+$1,916.26)

Not a terrible increase this month since I was fighting the market instead of it being at my back! Still have three and a half months to try to reach my goal of $100k. Really not sure if I’ll make it markets don’t give me a little boost at some point, but this month I’m going to start selling some stuff for some extra cash among other things, so we’ll see if that helps me out. There’s probably lots of ways to bring some extra cash I haven’t even thought of!

401k – $34,264.52 (-$1,261.88)

All market movement here and that really shows how things went this month. My rough math tells me that’s about a 4% decrease over last month! As always, 99% of my money is invested in S&P 500 index funds, which I continue to recommend over individual stocks. Total stock market index funds are great too, just don’t try to beat the market!

Cash – $19,186.90 (+$1,804.07)

Not shown here as usual are $2,000 dollars in contributions to my Fidelity accounts. Seems like I may have spent a little more money this month that usual, which adds up, because I had some unusual expenses (medical bill, political contributions, etc.). One thing that helped me was my September challenge to eat vegetarian, which made it nearly impossible to get any kind of fast food. I’ll be writing a separate article about it shortly, but my October challenge is to spend as little money as possible without negatively impacting my health (that means I still have to buy food)! I’ve already cancelled all my subscriptions to all the things and I’m locked in, keeping track of every dollar going out. We’ll see how this goes!

Roth IRA – $14,988.82 (+$400.99)

This was me putting $1,000 in and having the market take over half of it away. Like my 401k, this is all in the S&P 500, or more specifically FXAIX on Fidelity.

Brokerage – $3,323.33 (+$889.75)

Contributed $1,000 as usual to my Fidelity brokerage account also in the S&P 500 (FXAIX). I think SPCE had a really good month suddenly at the end, jumping like 14% over less than a week. Works for me, but I definitely have yet to break even.

HSA – $833.33 (+$83.33)

A little surprise here, it seems like my company is now putting in money by month instead of quarterly sums. Works for me! Still need to shoot an email about contributing my own money pretax because I want to make sure I can max out this year, but it always seems to get away from me!

Hope you enjoyed this net worth report! Happy saving!