Note: This is a repost from an old blog of mine, remixed with the graphs, headings ordering, and stylizations I normally do, but otherwise the text is unchanged. Hope you enjoy taking a look back at where this all began! -CJ

Hello readers! For those who are new, these are my monthly posts where I share all the details of my progress on my FIRE journey!

October was a good month overall! It felt good to get my spending under control and finally have a good idea of where to budget my money monthly. Markets weren’t great but with how the Coronavirus is going it’s really no surprise! We’ll see how things change after the election I suppose.

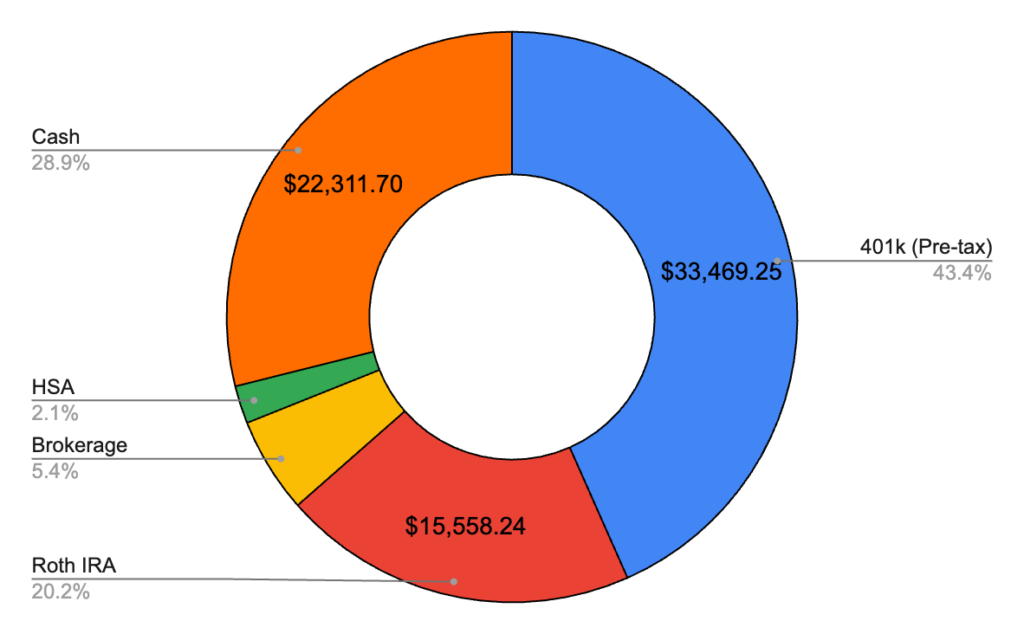

October 2020 – $77,178.96 (+$4,582.06)

Not so bad! I had set a goal of hitting 80k, but it relied on the market going up a few percentage points. Things looked good early October, but things reversed and ended up DOWN a few percentage points. I would’ve made it otherwise! I did a lot of things to help my savings this month, selling quite a few old, valuable video games and spending significantly less money than I usually do. I was able to boost the amount of money coming in by contributing to my HSA pre-tax, which was nice to get the ball rolling on. All in all, I did what I could, but the markets are gonna do what the markets are gonna do!

401k – $33,469.25 (-$795.27)

And this is where the good times end! The first half of the month was good for the S&P 500, seeing a 4.5% or so increase, and then a 7% decrease from October 12th to the end of the month. Yikes! Hopefully things improve in November but this might be the market finally realizing how bad things actually are with the Coronavirus. Number of cases per day is back to the worst it has ever been and my state hasn’t been doing particularly well either. We’ll see what happens, I’m just doing everything I can to stay safe and protect others in these hard times.

Only one other update in this arena. As I’ve likely stated, I’ve been unable to contribute to a 401k since getting my new job in May because of a weird policy of having to work there for 6 months. Well, that time is coming up, and I got an email allowing me to set up percentage of paycheck and where the money would go, etc. I think this won’t take effect until my December paychecks, but when it happens I’m ready to go with 80% of my paychecks going in to try to make up some lost ground.

Cash – $22,311.70 (+$3,124.80)

Now that’s what I’m talking about! As usual I put $2,000 in my Fidelity accounts. This might not seem like a major increase, but it is $1,000 higher than last month AND that’s with $800 going into my HSA pretax. So I did nearly $2,000 better in cash flow than last month! That’s insane! I had a trifecta of things helping me out in this area. First, as I talked about earlier in the month and in my retrospective, I tried to spend as little as possible. While I didn’t do a perfect job, I spent exactly $596 over the entire month, which was much better than previous months. I also sold at least $500 worth of video games on eBay during the month, which nearly covered all my expenses for the month! And finally, a late graduation/birthday present from my dad, which was $600. All in all, a good month in this area!

Roth IRA – $15,558.24 (+$569.42)

Another month of me putting $1,000 in and having the market take over half of it away! Like my 401k, this is all in the S&P 500, or more specifically FXAIX on Fidelity.

Brokerage – $4,184.22 (+$860.89)

Contributed $1,000 as usual to my Fidelity brokerage account also in the S&P 500 (FXAIX). Like everywhere, my accounts were down in terms of market movement.

HSA – $1,655.55 (+$822.22)

Hey I actually did do something about this! I changed my per paycheck contribution so I can max out my HSA by the end of the year. For some reason my employer, despite seemingly breaking up contributions per month starting last month, didn’t put anything in the account. Not sure why! But it feels good to get some more money in this account!

Hope you enjoyed this net worth report! Happy saving!