Note: This is a repost from an old blog of mine, remixed with the graphs, headings ordering, and stylizations I normally do, but otherwise the text is unchanged. Hope you enjoy taking a look back at where this all began! -CJ

Hello readers! For those who are new, these are my monthly posts where I share all the details of my progress on my FIRE journey!

November was a crazy month! After having been slower last month with the market ending up down for the month, things really picked up. Like many others I was glued to the election results for the first part of November, and the market seemed to like what it was seeing. The S&P 500 went up an incredible 10% over the month! In addition to good gains in the market, I continued to keep my expenses low and made a surprising number of sales on eBay, bringing in some extra cash.

With how awful Coronavirus continues to be, and honestly worsening all the time, the market continues to be very out of sync with a ton of folks daily lives in America. I think I just saw a pretty rough unemployment report not too many days ago. I continue to be thankful for mine and my family’s situation. And to anyone out there, I hope you had a safe and restful Thanksgiving with you and your family!

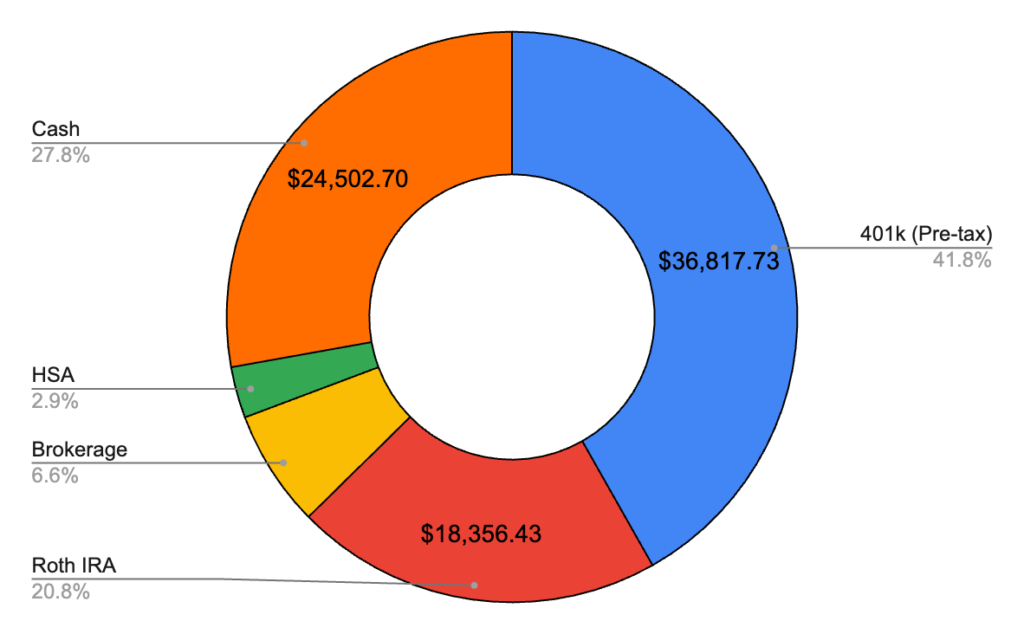

November 2020 – $88,079.12 (+$10,900.16)

Okay, now that’s insane. After missing my October goal of $80k by a decent margin, I actually got decently close to scratching $90k in a single month. A nearly $11k increase. If not for getting a severance paycheck in April, which is sorta cheating, this would be my record month by quite a bit. Gives me some hope of reaching my January 15th goal of $100k. Money continues to go into my HSA and finally, after 6 months of employment, I’m eligible for a 401k through my job, which begins in December. Looking forward to cramming in some last minute funds to try to catch up a little bit.

401k – $36,817.73 (+$3,348.48)

Well, last month in my report I state that “this might be the market finally realizing how bad things actually are with the Coronavirus”. Boy was I wrong! No point in timing the market folks, it works in ways that truly make no sense. As usual, no contributions here, but thankfully this is the last month I have to say that. As I mentioned above, starting with my first paycheck in December I’m enrolled in my company’s 401k program. I’m gonna be putting 80% in for both the last two paychecks of the year and then the first in January as I try to reach my goal of $100k by January 15th. After that I will change to distribute the contributions evenly across the year. As usual I’m all in the S&P 500 here (or whatever crappy 0.5% expense ratio approximation my job offers. If only they’d offer Vanguard or Fidelity!).

Cash – $24,502.70 (+$2,191.00)

A very solid increase here once again! This was helped by decreased spending and another $500 or so in profit from selling some old video games on eBay. As I’ve likely noted in the past, I’ve started to feel like I’m hoarding a bit too much in cash when considering my monthly expenses. As such, I’ve decided that, starting in December, instead of contributing $1,000 to my brokerage account to contribute $4k just so that I’m more fully invested in the market. My expenses were a bit higher than October, but not markedly so, and I continued to track every dollar that I spent. December will be a big month for gift buying so I’m sure October and November are going to go down as my best months this year in this area!

Roth IRA – $18,356.43 (+$2,798.19)

Contributed $1,000 here at the beginning of the month as usual, and the market did the rest! This account is starting to become a force to be reckoned with in terms of interest. I think at the beginning of the year it had only about $3k and thanks to the late contribution rules, I was about to max for 2019 and will be maxing for 2020 in the same year. Just one more $1,000 contribution until the new year!

Brokerage – $5,841.16 (+$1,656.94)

Contributed $1,000 as usual to my Fidelity brokerage account also in the S&P 500 (FXAIX). Things went well here much like any money I had invested in the market!

HSA – $2,561.10 (+$905.55)

Continuing to contribute here to try to max it out by the end of the year. At the turn of the new year I’ll reallocate so I’m contributing evenly throughout 2021.

Hope you enjoyed this net worth report! Happy saving!