Note: This is a repost from an old blog of mine, remixed with the graphs, headings ordering, and stylizations I normally do, but otherwise the text is unchanged. Hope you enjoy taking a look back at where this all began! -CJ

Hello readers! For those who are new, these are my monthly posts where I share all the details of my progress on my FIRE journey!

December was a pretty restful month for me. I was finally able to take a break from looking at the news all the time with the election over. I also was able to take a couple weeks off work and spent much of the month at my parents and was able to spend plenty of time with them. The S&P 500 went up about 4% this month, which continues to boggle the mind. With vaccines starting to roll out, I understand some of the optimism, but Coronavirus is still at its absolute worst and lots of people are still struggling. I hope everyone continues to stay safe and do what they can to limit the spread until we all get vaccinated.

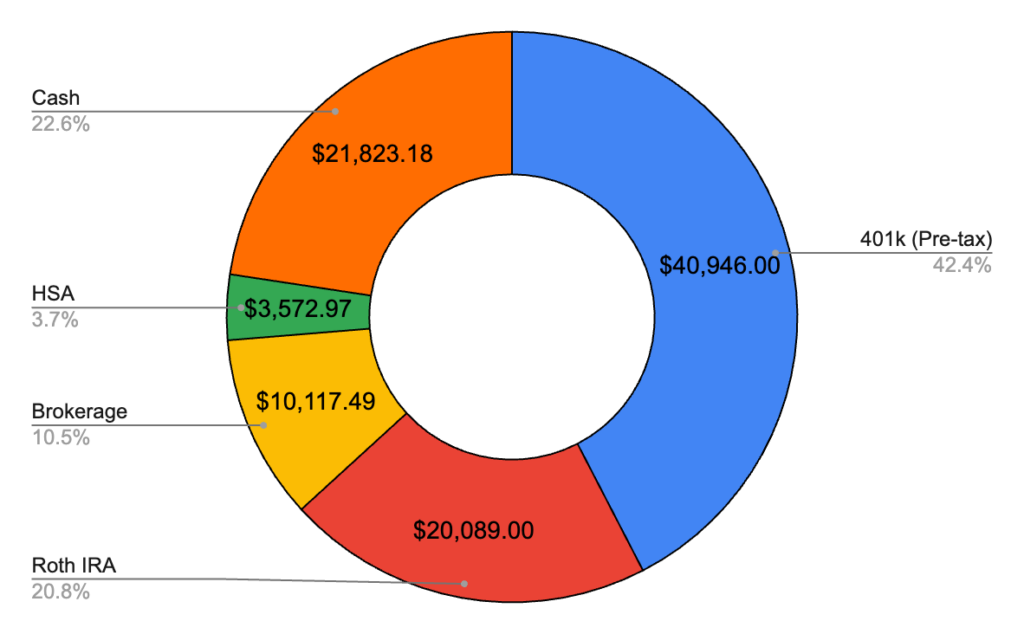

December 2020 – $96,548.64 (+$8,469.52)

Now that’s a solid increase! I not only passed $90k, but I managed to get to a point where I can say I’m close to $100k. Seeing this increase really cements how things start to pick up the more money you have invested. I probably made (considering 401k investments) about $5k – $6k this month from my job (plus $600 in stimulus money), and then spent, between rent and other things, somewhere in the range of $600 – $800. That means the market brought in literally $3k in a single month. That is insane. I’m excited to see how things accelerate in the new year. Of course my goal is to hit $100k by January 15th but I think I’m gonna hit it by the end of next month no matter what, which is 6 months ahead of the goal I set when in college. Very exciting to see it coming together.

401k – $40,946.00 (+$4,128.27)

Finally, some more money coming into my 401k! Obviously my biggest disappointment of 2020 money wise was not being able to max this account out thanks to my job requiring 6 months of employment, but my final paycheck of the year put nearly $3,000 into my new 401k. In 2021 I’ll be adjusting to put the money in evenly across my paychecks to max it out by the end of the year.

Cash – $21,823.18 (-$2,679.52)

My cash going down? What? But of course, this was expected! As I mentioned last month I’ve started to feel like I had a little too much in savings relative to the amount of money I spend per month. I had well over even a years worth of expenses and that’s probably just too much when it’s so easy to pull money out of a Roth IRA if necessary. I had $4,000 go into my brokerage account and then $1,000 into my Roth IRA. Expenses this month were likely not too much higher than November since I was home with my parents a lot of the month, but I didn’t do a great job keeping track.

Roth IRA – $20,089.00 (+$1,732.57)

And with that, my Roth IRA was maxed out for 2020. Thanks to the contribution rules, I ended up maxing out for 2019 and 2020 all in the same year! The market was good here too, picking up about $700 just in growth.

Brokerage – $10,117.49 (+$4,276.33)

Moved my contribution up from the usual $1,000 to $4,000 to start to slowly eat at my savings. It feels like it makes the most sense to have as much invested as possible while also keeping enough in savings to cover emergencies.

HSA – $3,572.97 (+$1,011.87)

Contributed a little more money here to max out my HSA for the year! I also was finally able to start investing some of this money too, which is also in the S&P 500 as always. I’m continuing to save my medical receipts so this money can be pulled out at a later date.

Hope you enjoyed this net worth report! Happy saving!