Hey folks! As promised in my first post, I intend to do a monthly breakdown of my savings and spending to share my progress on the road to early retirement. I’ve always enjoyed reading about other folks’ journeys and got a lot of value out of their updates, especially when I was in my early days of learning about FIRE. It’s probably gonna take some deeper explaining in other posts to break down how and why we got here, but I’ll just attempt to drop you into this last month to get a feel for what’s going on. Here we go!

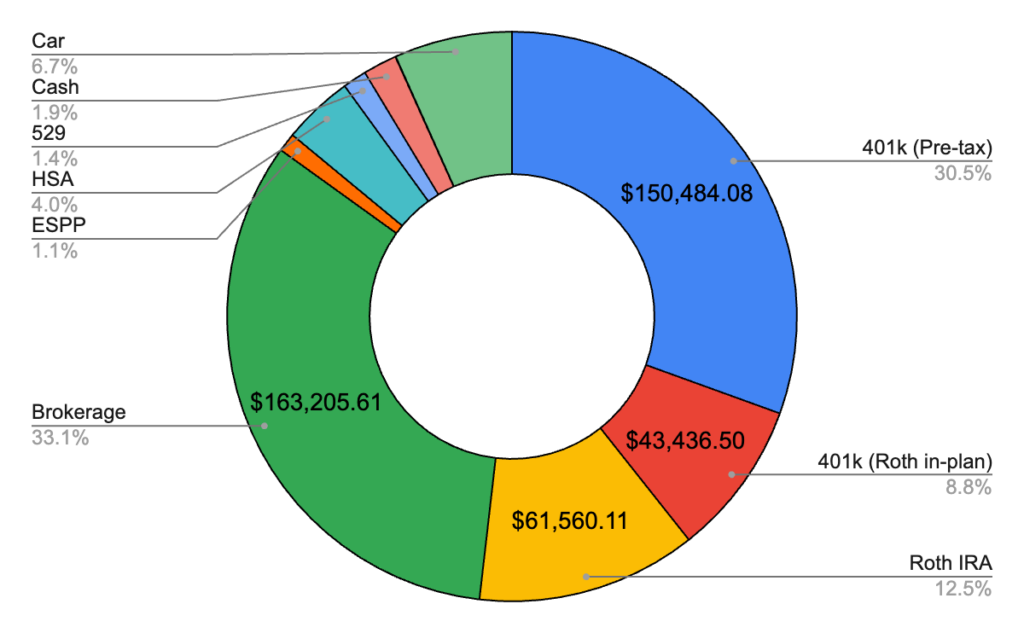

March 2024 – $489,607.53 (+$31,261.09)

Total Investment Contributions – $19,500

Alright! Trying to not get too used to this much upward movement every month, but damn, this market run up since October’s definitely been juicing the S&P 500. You’ll get sick of hearing me talk about the S&P 500, but to get one thing clear up front, every single dollar I have invested is in the S&P 500 (at least for now, I’m gonna end up with some company stock at some point but intend to sell ASAP). Nothing else. Specifically I have it all in Fidelity’s S&P 500 mutual fund FXAIX. Well, actually, my non Fidelity 401k is in the closest approximation I could get, but whatever. Why not an ETF instead? Well when I started doing this I didn’t know what an ETF was! And why not switch now that I do know? Well FXAIX actually has a lower expense ratio than any S&P 500 ETF. Yeah even VOO. Granted, VOO does have a fairly rock bottom 0.03% expense ratio, but FXAIX is actually half that at 0.015%, so I see no point in switching. Why not FZROX? Well, it’s not an option in my 401k, and it’s been easier to just keep it all the same. Same reason for not switching to Vanguard, just not worth the switching cost at this point. At some point I might get swayed from being all in on the S&P 500 to being all in on total market index funds, but in practice the returns have been so close to the same I haven’t felt any real heartburn the way I’m doing things. With all that out of the way let’s break it down by account, largest to smallest!

Brokerage – $163,205.61

My good ol’ brokerage account, where I throw my money when I can’t throw it anywhere else! This month, like most months since this year started, I contributed $9,787.16. That probably seems oddly specific, and it is, but it’s also just what’s left once I do everything else. This thing has definitely grown a lot since 2020, and I used to think about how I was likely going to end up paying taxes on a lot of those gains. Eventually I realized how favorable capital gains taxes are, and in what I intend to be a modest early retirement it’s likely I won’t end up paying a dime. So I’ll just keep throwing whatever money I can at this thing.

401k Pre-Tax – $150,484.08

This total is actually an amalgamation of two 401ks that I have and contribute to monthly. One of those weird things that happens when you have two full time jobs like I do! Only one of my jobs has a match, so I contribute up to that amount there, and then contribute more to my other job for reasons that will make sense below! Of course, having two 401ks like this doesn’t mean I get to skirt around the IRS’s limit of $23,000! This month I contributed $1,917.00, which is just because I’m contributing up to the limit in 12 equal installments. For my job with the match I kinda have to do that anyways if I want to get the full match, the other I guess I just choose to do this to keep my contributions nice and even every month. I’ve maxed this out every year since 2019 except for 2020 because of a job switch that then had a weird six-month waiting period before I could get a 401k.

Roth IRA – $61,560.11

My trusty Roth IRA that I opened when I turned 18! I didn’t start properly using it until a bit later, but I’ve maxed this out every year since 2019 as well. I’m now above the income limits for a Roth IRA, which happened unexpectedly a couple years ago, so I had to go through the fun of re-characterization. But then I started doing the magical backdoor Roth, which is really just contributing to a Traditional IRA and then converting that money to a Roth IRA. I did it sorta wrong last year, in that I contributed to the Traditional IRA in installments and didn’t convert to a Roth IRA immediately, meaning I had to pay taxes on the growth. Done properly, like I did earlier this year, if you just contribute the maximum right away, which this year is $7,000, and then convert right away, then there’s no taxes since you didn’t give it time to grow! There’s other considerations around this concerning the pro-rata rule, which I ran into last year and managed to maneuver out of, which I’ll definitely write about more. Generally though, I expect to do these type of backdoor conversions as long as they’re allowed and I’m working! No contributions here this month and there won’t be any more this year since I’m at the limit.

401k Roth In-Plan Conversion – $43,436.50

What a mouthful! This is the portion of my 401k that’s dedicated to what’s called the mega-backdoor Roth IRA. Up until starting my second full time job last year, I didn’t have access to this at any point in my working career. Basically some 401ks allow you to contribute after-tax dollars beyond whatever the usual stated contribution limits are, which as I mentioned above is $23k this year (and that $23k limit is universal even if you have multiple jobs). That’s because there’s actually a second limit, called the employer limit, that’s specific to each job. This year that limit is $69,000. What counts against this limit is all of your contributions (either pre-tax or Roth), all of the employer’s match, and then any of these after-tax dollars if your plan allows it. Then the second sneaky part is that some employers have what are called “Roth in-plan conversions” that basically take that after-tax money you put in and immediately convert it into a Roth 401k or IRA of sorts, in that the money will grow tax free for life. There’s another way this can be achieved if your employer allows for in-plan withdrawals, where you can do the conversion yourself, but for me the in-plan conversion is easier since I have access to it. It’s worth noting I did actually have to call Fidelity to get this set up, as it wasn’t an obvious option on their UI. This is a huge loophole in the tax code and I’m taking advantage of it as much as I possibly can while it’s still around. This month I contributed $4,375.00, which I intend to do every month this year. This is also why I choose to only contribute to this job’s 401k up to the match, and do the rest of my universal $23k limit at the other job. Again, the $69k limit is per employer, so I want to give myself as much room as possible to make these contributions while not throwing away the free money my employer is giving me. Though those contributions they’re giving me don’t vest for four years so I’m not sure I’m ever gonna see that money, I still think it’s best to take it in the case my plans change.

Car – $33,000.00

My beautiful blue 2020 Tesla Model 3 I got used last year. I keep it in my net worth for a couple reasons. For one it’s a decent chunk of change, and I think it’s fair to keep it in since it does have real cash value that could be had any time I wanted to sell it. I also have to feel the pain of the car depreciating in value every so often when I check its KBB value. It hasn’t deprecated much from the price I bought it at, which is partially thanks to buying it used! This was definitely my biggest purchase to date, but after entering 2023 with the same $2k car I bought when I was 16, I felt like enough was enough. A Tesla has been my dream car since I was 18, and I decided to finally let myself have it. Hoping to make this last a decade or more, since I’m not really someone who gets new car fever. Just didn’t want to pay expensive gas costs and continue polluting the environment. And though it doesn’t always do a perfect job, the car can literally drive itself!

HSA – $19,765.93

I just got this one mostly consolidated into Fidelity this month! Both my employers combined contribute about $175 a month and then I contribute about the same myself, $170.84 each month. That’s because the limits on HSAs are much lower than other tax advantaged accounts, a mere $4,150 this year. I haven’t touched a dime of this money and choose to pay for any medical costs out of pocket. That’s because HSAs are the most powerful retirement accounts if left alone: it’s the only account that’s tax-free on the way in, grows tax-free, and then is tax-free on the way out. So it’s a lot better if I just leave it and let it grow. I’m sure I’ll have some medical expenses down the line and I’ll be happy to have it.

Cash – $9,477.59

My cold hard cash. Most of this is in a HYSA account making a little over 4% a year. I try to keep a few months of expenses in an emergency fund and then I have a small slush fund account for if (and let’s be honest, when) I go over my monthly budget so I can continue to invest the same amount monthly uninterrupted. That system is seemingly working for me so far this year!

529 – $6,678.00

I started up a 529 last year because I wanted to start saving for my future children’s college costs since I’m figuring it’s gonna get even more expensive than it is now. This year I opened up a couple more just so that each kid can be the beneficiary on one account, since there’s now a way to roll excess funds into a Roth IRA but only if it’s in one beneficiaries name for 15 years. And also it’s probably just easier to not change the beneficiary all the time. I’m contributing $1,500 a month to this, $500 to each 529. If I do end up retiring as early as I’m thinking, this might not end up with nearly as much as I’d hoped, so I intend to throw some of whatever extra income I make into these accounts along the way. And if I end up having less than three kids I can just consolidate later!

ESPP – $5,250.03

The money here isn’t invested yet, but it will be at the end of June. One of the companies I work for has an ESPP that has a 15% discount, but unfortunately also forces you to hold on to the shares for a couple of years. If I could, I would just sell out and buy more shares of FXAIX. I decided it might still be worth it anyways, and will end up being a fairly small percentage of my overall investments. Since RSUs I have vesting later this year I will be selling immediately, this ESPP will be my only exposure to company stock. The yearly limit on ESPP contributions is $25k, but you have to factor in the 15% discount, which means it’s really a limit of $21.25k. I contribute $1,750.00 a month here, which will put me just under that limit at the end of the year. We’ll see if this ends up being a mistake in the long run, but figure I should at least give it a shot.

Bonds – $109.68

My dad got me a Series EE Bond in late 2001. It cost him $50. #windfall!!!! I really gotta just take this thing into a bank sometime and get it over with.

Federal Taxes Owed – -$3,360.00

The government gave me too much money over the year, so in December 2024 I went back to try to distribute what I owed evenly over these reports.

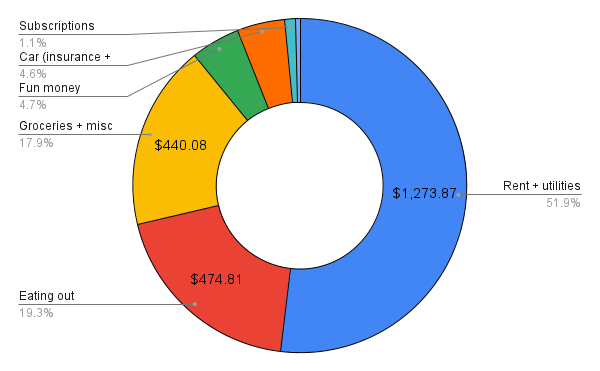

March 2024 Budget – $2,242.02

Total Spending – $2,455.08 (+$213.06)

Only a little bit over budget this month! And much less so than the last couple months (but let’s not talk about that)! It was a pretty quiet month, so not too surprised to see this come close, but there’s still some areas I could stand to spend less in to allow for more fun spending elsewhere.

Rent + Utilities – $1,273.87

Not much I can do to bring this one down. My girlfriend and I split the rent and utilities, and currently I pay a bit more than 75%. But this is still a lot cheaper than other rent I’ve paid in the past!

Eating out – $474.81

This was for the two of us. And yeah it was kind of a lot! Even a little more than we spent on groceries! A good amount was meals, and once we went out for some drinks. I’m gonna cut back on this a little next month, since I’d rather allocate some of this money to travel and fun experiences. We have a couple trips on the books for next month.

Groceries + misc expenses – $440.08

The total grocery and necessity spend for both of us. We use Shipt and so this includes tips to any delivery drivers that bring our groceries to us. It’s really been a great service! This was probably just a bit lower than usual grocery spend because of the aforementioned eating out. But we still ate the large majority of meals at home!

Fun money – $115.25

Nothing too major here, with the biggest expense being baseball tickets for us for next month. Finally the season is starting again! Otherwise just some odds and ends.

Car expenses – $113.59

This was my insurance, which was about $70, and then any electricity costs to drive my car. Nothing too special or crazy here. But I’ve been enjoying the cheaper insurance since I keep a good safety score on my Tesla!

Subscriptions – $26.98

Just a few things here, including our subscription to a local composting co-op. Should come down a bit since I canceled my news subscription. I need to take a break!

Donations – $10.50

I finally realized that I accidentally set up a recurring donation sometime last year! Whoops! At least it was going to a good cause!

March 2024 Savings Rate – 88.1%

Folks seem to have different ways of calculating their savings rates, so for transparency I’ll go over how I calculate mine. It’s never made that much sense to me to calculate off of gross income, since even if you do what you can, there’s always a certain amount of taxes you’re going to have to pay. My gross income is not money in my hand. So instead I take the total amount I spent divided by the total amount of my money that goes anywhere BESIDES taxes each month, so any investments, 401k, cash, etc. Crucially this does NOT include what my employer matches in my 401k or any HSA money they contribute. It only counts money that is either coming from (or out of) my paycheck. So this month that math was 2455.08 / 20,622.02. That means my spending rate was 11.9%, and conversely, my savings rate was 88.1%.

I’ll write more about the breakdown of where all the income comes from, but it’s pretty close to 50/50 between my two jobs. It’s definitely been a game changer to go from one income to two all by myself. It also means I’m underpaying on taxes a bit, since the government is only seeing each job by themselves, but I’m also overpaying on Social Security tax, since each job is taking up to the full amount. It doesn’t quite wash out, and I’m likely to owe something like $10k in taxes next year assuming I keep both jobs through the end of the year. That being said, I’m not worried about making quarterly payments since my situation for last years taxes was more normal and you get a grace year.

Anyways, future reports should be a fair bit shorter than this but wanted to make sure I went into the necessary detail to paint a complete picture. Next month I should finally cross the half million threshold, so stay tuned!