Note: This is a repost from an old blog of mine, remixed with the graphs, headings ordering, and stylizations I normally do, but otherwise the text is unchanged. Hope you enjoy taking a look back at where this all began! -CJ

Hello readers! For those who are new, these are my monthly posts where I share all the details of my progress on my FIRE journey!

January was a month of getting used to the old routine. It was back to work, and back to living apart from my parents. It’s always nice to get back into the swing of things after a bit of a break. I feel very optimistic about the New Year and all I hope to accomplish and it was good to get a start on making those resolutions come true!

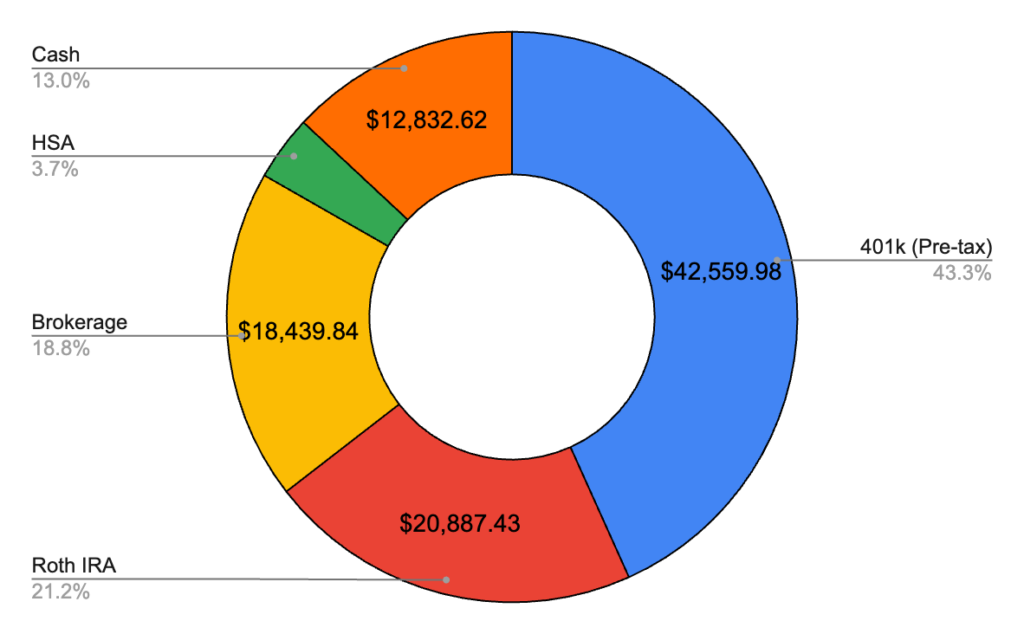

January 2021 – $98,340.94 (+$1,792.30)

Hey that’s not too bad, all things considered! A much smaller increase than the last couple months but this makes sense to me for reasons I elaborate on below. I was on track to hit 100k if not for the sudden downturn of the S&P 500 on January 29th. I could almost taste it! But now my victory is assured next month! Six-figure club here I come! And hopefully I get my taxes filed nice and early and maybe get that money in February too, I have about $3,000 coming I believe! The end of January was crazy, from the 26th to the 29th the S&P 500 dropped like 3.5% after having a solid month. With the amount of money I have invested and spent this month, I’m just happy I was still green for the month!

401k – $42,559.98 (+$1,613.98)

As I stated in my last update, the money is now coming in evenly per paycheck now, and since I have 24 in a year that comes to $812.15. Other than that, it wasn’t a great month for the market as I stated above. Still very glad to have a 401k this year and very excited to max it out.

Roth IRA – $20,887.43 (+$798.43)

My $1,000 contribution here getting beaten back by the stock market going down this month. I meant to switch my contributions to $500 considering there’s 12 months in the year, but I guess it doesn’t really matter!

Brokerage – $18,439.84 (+$8,322.35)

Woah! Lots of money going in here! This was partially from upping my monthly contribution from $1,000 to $4,000 last month, but I also was putting some money in on Robinhood during the GME/AMC craze. I didn’t make it big time, but I also didn’t lose money, so I’m calling it even. I ended up finally selling my long held SPCE at a healthy $200 profit, and I will now be closing my Robinhood account. I really disagree with how they handled stopping sales of stocks during this whole thing and it left a bad taste in my mouth. So, expect to see brokerage be pretty even next month!

Cash – $12,832.62 (-$8,990.56)

Now that’s a lot of cash going out! Why’d that happen? Well it was a lot of things contributing here. For one, as usual, I had $1,000 go to my Roth IRA and $4,000 go to my brokerage account, but this month I also put $4,000 into my Robinhood account (which I talk a little bit about below). In addition, I had $2,000 in tuition expenses for grad school, which ate at this a little more. And finally, I read this fantastic article this month that convinced me that donating 10% of my pretax income to effective charities was a good idea, so that took about $700 that normally wouldn’t be going out but will now be a monthly expense. I highly, highly recommend that article. I’ve always felt like I would wait to donate money until I “made it” and had all the money I could ask for. This article helped me shift my perspective to realize that in a way, I’ve already made it, like many folks in the US, in the sense that I’m doing leagues better money wise than 95%+ of the entire world. We truly don’t realize how good a lot of us have it!

HSA – $3,621.07 (+$48.10)

What?! No contributions here? Yeah, I guess my job misunderstood what I meant when I reallocated the amount going into my 401k to be the ONLY pretax money I wanted coming out of my paycheck. I’m not too stressed about this since it’s really easy to max out compared to the 401k so I might wait a little while to start putting money in here again. Definitely will still hit the limit later in the year.

Hope you enjoyed this net worth report! Happy saving!