Note: This is a repost from an old blog of mine, remixed with the graphs, headings ordering, and stylizations I normally do, but otherwise the text is unchanged. Hope you enjoy taking a look back at where this all began! -CJ

Well folks, this is one of the big ones. After having seen this milestone in my mind for two years now, it’s finally here: the elusive first $100k! And it’s a lot earlier than I’d initially hoped. February 3rd was the day I officially cracked $100k. Back in undergrad, my goal was to hit this mid-July of this year, and I’m proud to say that I well exceeded that goal. A good question might be, why? I did so much calculating when in college to figure out if it was possible, what did I underestimate? I think market returns were a bit higher than I’d calculated for, for starters. This was also before I knew what my first real salary would be, which in my calculations I was undershooting by about $10k. And then in May of 2020, when I got my new job, I was able to negotiate a raise of $8k. And really, both of those things came down to dumb luck, which is hard to predict! Obviously the biggest thing of all past that was keeping my expenses about as low as I could. My rent is cheaper now than I would’ve been able to predict and much cheaper than in early 2020.

I’m extremely fortunate to be in the position I am. So much luck and privilege have gotten me to the point I’m at, and I constantly remind myself of that. No, there were no windfalls, no inheritance, but I’d be lying to say that the I got here by pulling myself up by my bootstraps. It’s sort of just how life goes, I think. I can trace most of the biggest pieces that got me here to being in the right place at the right time. Whether it’s the conversation with my best friend who got me fired up about us saving our first $10k, being the last person selected for my full ride scholarship cohort because someone else didn’t pick up their phone, happening to go to the regular career fair after the IS&T career fair (which resulted in my first internship and then full time job), or just the upward movement of the market. Anyways, that’s enough rambling. I’m excited to see what the future months bring. Supposedly $100k is where things start to pick up, so I’m excited to see how that pans out. Let’s get into the numbers!

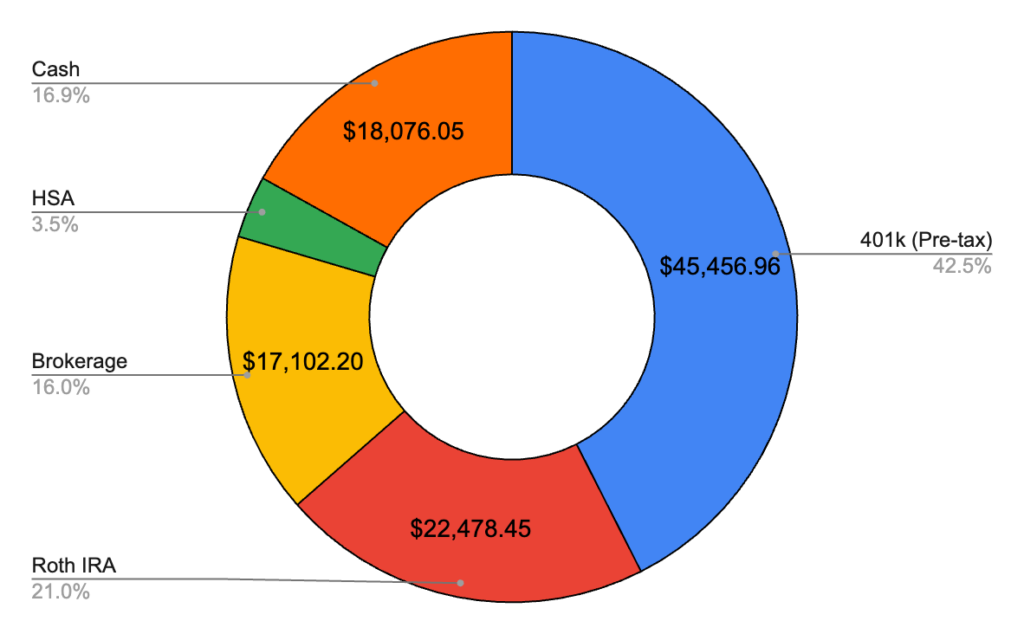

February 2021 – $106,883.85 (+$8,542.91)

Much stronger month than January. The market was up 2.5%, even with the dip at the end that felt very reminiscent of the end of January. I had my tax return come in here too which helped propel me upward just a little more. Not a whole lot more to say than what I have above, but it feels good to have reached this milestone.

401k – $45,456.96 (+$2,896.98)

About $1k per paycheck this month in here and then about $1k of market movement, sweet! I’m continuing to invest my paychecks evenly across the year, all in the S&P 500.

Roth IRA – $22,478.45 (+$1,591.02)

Another $1k in here, then some market movement pulling it up a little more. Guess I’m just going to max out my Roth IRA in June at this rate!

Cash – $18,076.05 (+$5,243.43)

As mentioned last month, I planned to cash out of Robinhood and that’s exactly what I did here. Some of it was just cash coming in from work, but with the sizable amounts going out to my Roth IRA and Fidelity brokerage, along with my donation money, a lot of it is just the Robinhood money. I pretty much broke even on the whole GME, AMC, etc. thing and don’t feel upset about it. Could’ve lost a lot for sure!

Brokerage – $17,102.20 (-$1,337.64)

And there’s the red! I did put $3k in here and there was upward market movement, but pulling out $4.5k from Robinhood is the culprit here. Good riddance Robinhood, now no one can stop me from making my trades!

HSA – $3,770.19 (+$149.12)

No contributions here by me but a small contribution by my employer. Going to max out my HSA by the end of the year, just haven’t gotten it set up for this year yet.

Hope you enjoyed this net worth report! Happy saving!