Note: This is a repost from an old blog of mine, remixed with the graphs, headings ordering, and stylizations I normally do, but otherwise the text is unchanged. Hope you enjoy taking a look back at where this all began! -CJ

Hello readers! For those who are new, these are my monthly posts where I share all the details of my progress on my FIRE journey!

March has been a pretty solid month for me, with lots of big events. I finally got my first shot of the good ‘ol Pfizer vaccine just a few days ago and am excited to return to semi-normal life once I’m fully immune to this virus. What a year it has been! I also ended up quitting my current job this month because of an offer I’d received in February. Oddly enough, this is with the employer that, right near the beginning of this blog, I talked briefly about being laid off from. Well, in the year that has followed, a good friend of mine has become a manager over there and has been trying to poach me back as they try to rescale their software team back up (the company that acquired them kinda realized they were a little hasty with those layoffs- hilarious). When he last reached out six months or so, he couldn’t really beat my current salary of $85k, which was understandable, so I decided to stay in place. Well, in February he hit me with the bombshell: come back and we’ll give you $105k. It took a month of deliberation, but it’s hard to leave that much on the table. So I put in my formal notice about a week ago and start in a couple weeks! Exciting stuff! I don’t plan on changing my lifestyle in any way, so it should just help get me to my goals faster, and honestly probably requires me to make them more ambitious. I also, as I’ll detail below, had a big month selling stuff on eBay. With a good market this month, it was really good money wise. Let’s get into the details!

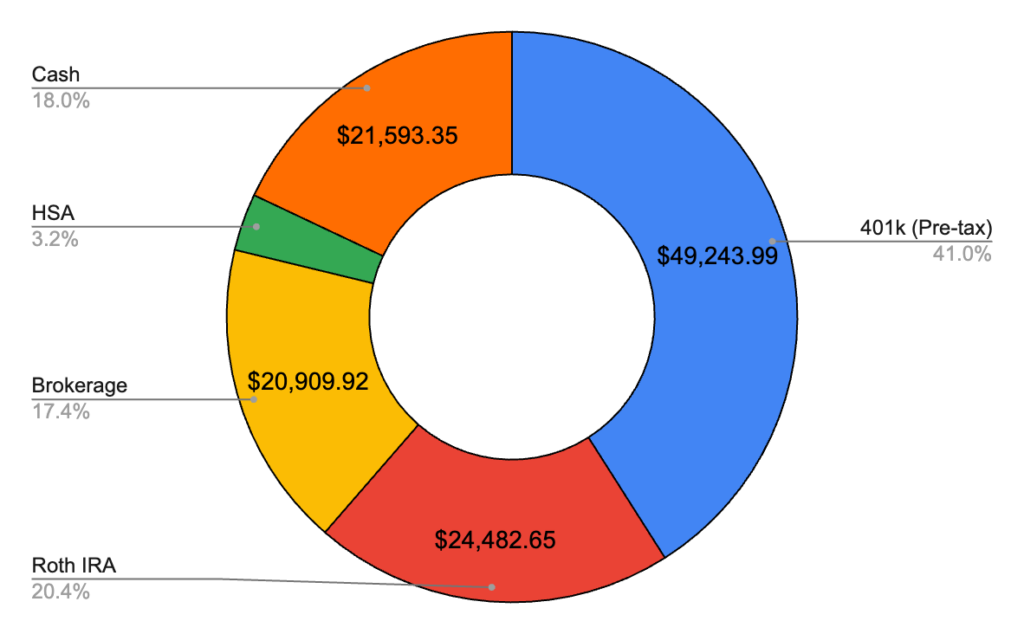

March 2021 – $120,120.91 (+$13,237.06)

Woah! This beats out November as my biggest increase yet, barring the month where I got that severance check (but I was damn close to beating that too)! The market was up 4.2% for the month which was phenomenal, and writing this on April 1st, it looks like it’s not done yet! As I’ll get to in the cash section, besides a good market, this exceptional month is definitely due to some side hustling selling a bunch of stuff on eBay.

401k – $49,243.99 (+$3,787.03)

About $2k from my paychecks here and the rest is market movement! Incredibly solid! For fun I went back and looked at, for all three 401k’s I’ve invested in, how much of this amount is my own money vs growth and employer contributions. By my math, $28,406 of it is directly from my paychecks. So about 40% of the above figure isn’t even money I put in! What a deal!

Roth IRA – $24,482.65 (+$2,004.20)

Nice and even here: $1k of my money and $1k by the market. Still on track to max out in June, at which point I’ll turn my sights to putting extra in brokerage probably. All in the S&P 500 as always.

Cash – $21,593.35 (+$3,517.30)

Keeping in mind that $3k went into brokerage and $1k into my Roth IRA, it sure seems like a large uptick here! Well as I’d been entertaining for about six months, I finally pulled the trigger: I listed to large majority of my monumental video game collection on eBay. I’m talking consoles, games, accessories, the whole nine yards. I put up 226 auctions all told, started them at a penny, and let ’em go for a week. The results? After eBay’s cut and paying for shipping: $4,000! Extremely solid. My reason for selling them has a lot less to do with the money and more about trying to pair down. I had a huge tote filled with games and consoles I didn’t play enough to justify it, and my dream is to still be able to move with my possessions fitting in my car. That being said I don’t hate the money either! I was funneling money into brokerage all this time in the hopes to not have as much money in cash, but it feels like, looking back at December’s report, I’m kinda where I started! I think I’m gonna go up from $3k a month to $5k into brokerage, especially in light of the pay raise. I want to have as much market exposure as I can and there’s no emergency where $20k is necessary, at least that I’m aware of.

Brokerage – $20,909.92 (+$3,807.72)

$3k from me and $1k from market growth! This account is going to pass my Roth IRA in short order, which is crazy because I only opened this last July! I guess that’s the power of not having a cap on contributions.

HSA – $3,891.00 (+$120.81)

Another employer contribution here. Will start worrying about my own contributions once I’m settled at my new job. Still planning to max this out for the year.

Hope you enjoyed this net worth report! Happy saving!