Note: This is a repost from an old blog of mine, remixed with the graphs, headings ordering, and stylizations I normally do, but otherwise the text is unchanged. Hope you enjoy taking a look back at where this all began! -CJ

Hello readers! For those who are new, these are my monthly posts where I share all the details of my progress on my FIRE journey!

April was a great month, all in all. I got my second dose of the Pfizer vaccine, and within a few days of writing this, will be (at least 95% – 99%) immune to the virus. I know as a country, and especially as a planet, we’re not out of the woods yet, but I have hope we’re on the right track. I also started my new job and have been happy about the change. It’s a lot of folks I’ve worked with before, and I’ve been able to get right into the groove of working with them and the tech stack.

This post marks a year of doing net worth reports on this blog, since April 2020 was my first one. Now I can compare year to year as the months go on, which will be interesting! I hope soon I can find some time to write articles that aren’t just net worth reports, but I’m always glad to do these because it keeps my eye on where my money is going each month.

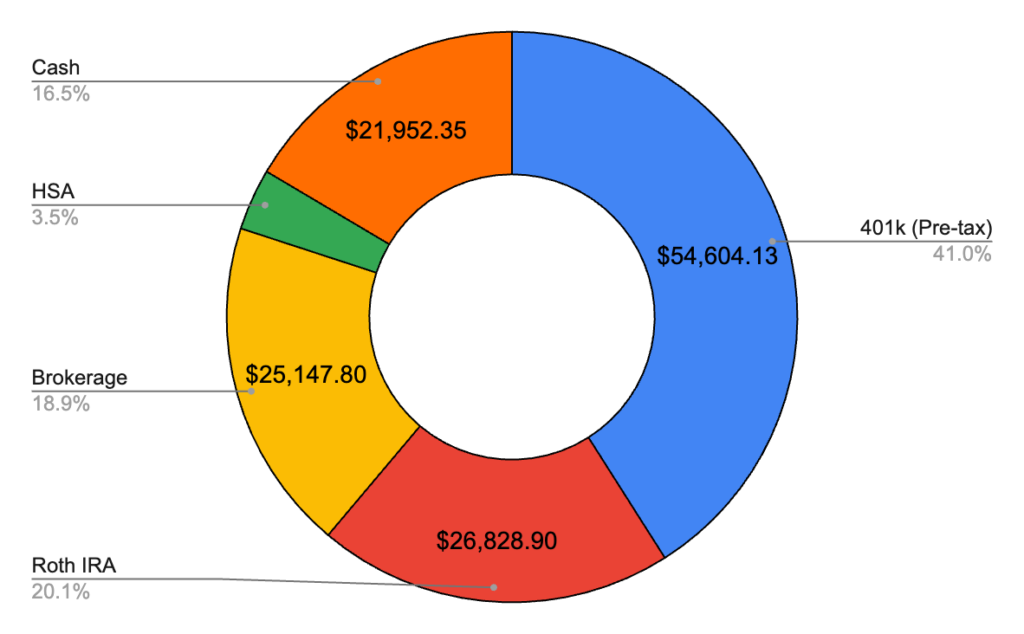

April 2021 – $133,183.69 (+$13,062.78)

Well that’s more than I expected! Very nearly tied last month in this increase, and I only made half as much money from eBay as in March! How’d I make up for it then? Well in April the market went up 5.24% compared to 4.2% in March, so that accounts for roughly $1k. I also had some pay overlap that resulted in getting my first paycheck from my new job and a paycheck from my old job that was about 60% of normal. So basically 2.6 paychecks this month, which helped!

401k – $54,604.13 (+$5,360.14)

Pretty nice jump here! To my surprise, despite my new employer having a 30 day waiting period for starting (and in my case, continuing) a 401k, it seems like my old info on file for per paycheck contribution just picked up right on my first check, so I had about $3k coming in here between my two employers! The rest was just fantastic market movement.

Roth IRA – $26,828.90 (+$2,346.25)

Nice and even here: $1k of my money and $1k by the market. Still on track to max out in June, at which point I’ll turn my sights to putting extra in brokerage probably. All in the S&P 500 as always.

Brokerage – $25,147.80 (+$4,237.88)

Similar to last month, $3k from me and a little more than $1k from market growth! All in the S&P 500 here, much like my 401k and Roth IRA. I’ve been considering getting a little money in crypto (missing the DOGE boom hurts, man!) but haven’t pulled the trigger yet. I wouldn’t do any more than a couple thousand, but still considering my options.

Cash – $21,952.35 (+$359.00)

About even here! This is no surprise to me, since about $5k came in via paychecks ($3k automatically went to 401k, see below), $2k from more eBay sales and then $4k out to Fidelity (Roth and Brokerage), about $1k to charity and about $2k to expenses for the month. Felt like my personal expenses were a bit higher this month than usual, partially because of more spending on food, both from the grocery store and eating out, as well as buying a plane ticket to Florida, where I’m going in early May (fully vaccinated baby!) to see a friend who moved out there temporarily. I’m on a gym kick right now because of a bet, so I have a gym membership ($40 a month) and have been purchasing protein powder and some other extra food, which increased my expenses as well. I didn’t do great at keeping track of my expenses in general in April, but I’m back on the ball for May tracking my spending in EveryDollar. All in all not too upset about April in this category!

HSA – $4,650.51 (+$759.51)

Finally some movement here! My new employer front loaded some money for their yearly contribution, and I started contributing $150 per paycheck. Before long I should have enough in this employer’s HSA to allow me to invest, but I could speed that up by rolling my two HSA’s together. Something I’ll have to look into.

Hope you enjoyed this net worth report! Happy saving!