Hey folks! Taking that dive into my old net worth reports got me curious: what were my yearly savings rates going back the last several years? How much was I spending each year? And how much was I investing, and in what?

I gathered as much relevant documentation as possible to get things as close to accurate as possible. While I’m sure what I’m presenting here is fairly close to accurate, it’s certainly not spot on either. Even with my Empower going back to 2018, I don’t have all my paystubs, but I do have my numbers from SSA that helped me figure out what my gross income was (I just had to add my HSA earnings back in to get the real number), and then used my tax returns to determine my net income. For a while my 2022 numbers just seemed wrong, until I remembered I got some RSUs that were counted in my gross income, and therefore also needed to be counted as an investment to balance things out. Anyways, let’s get into the data!

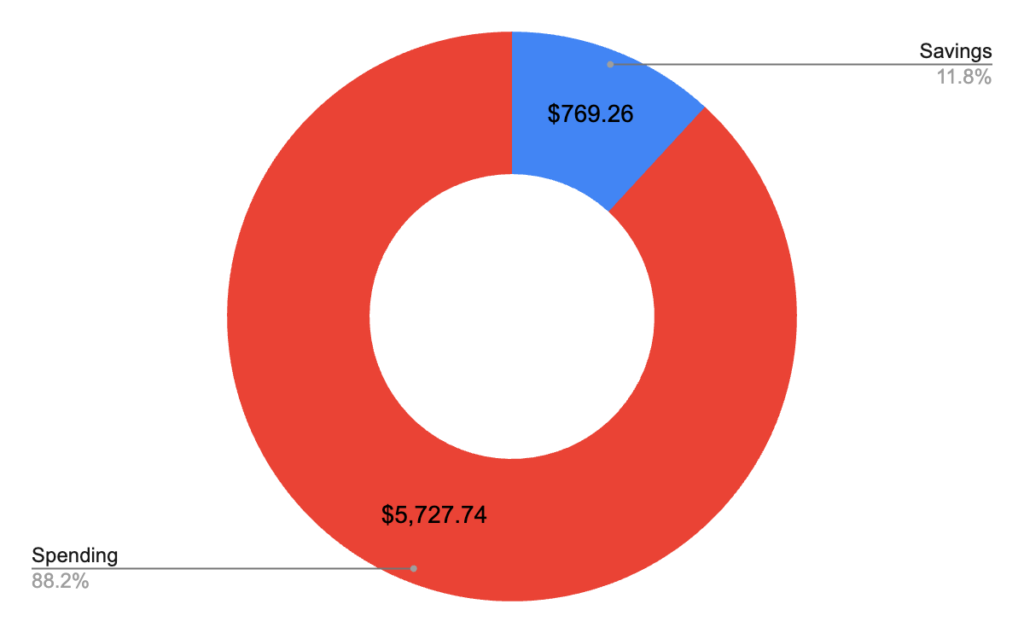

2017

In 2017 I was still finishing high school, then starting college, and had never heard of FI in my life. My savings rate of 11.8% reflects that:

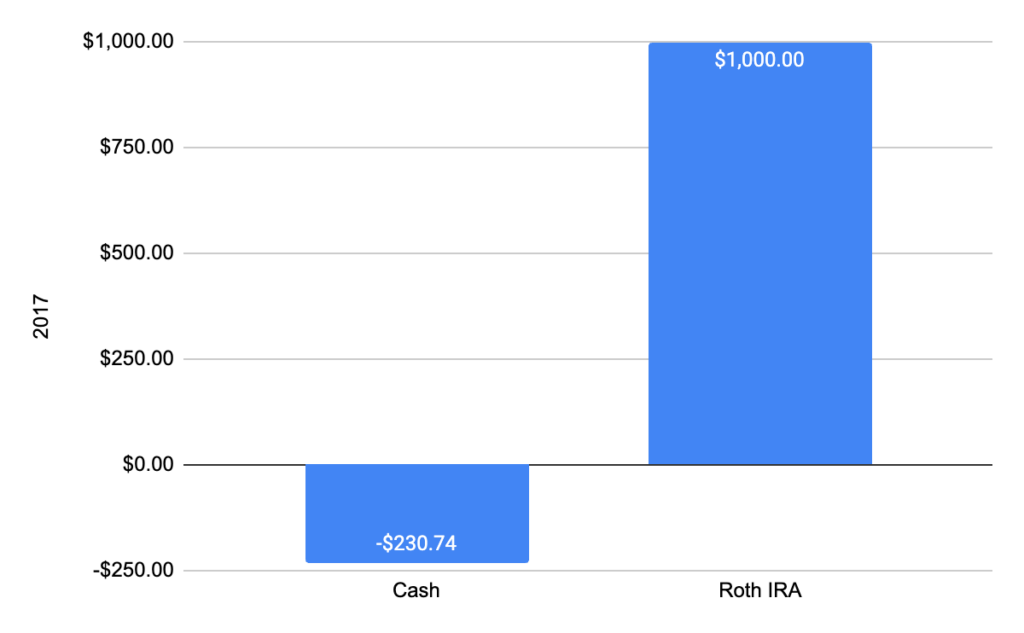

But thankfully, my dad told me I should set up a Roth IRA once I turned 18, so this is how my savings broke down in 2017:

It’s a start! If only I had known I needed to actually invest that $1,000!

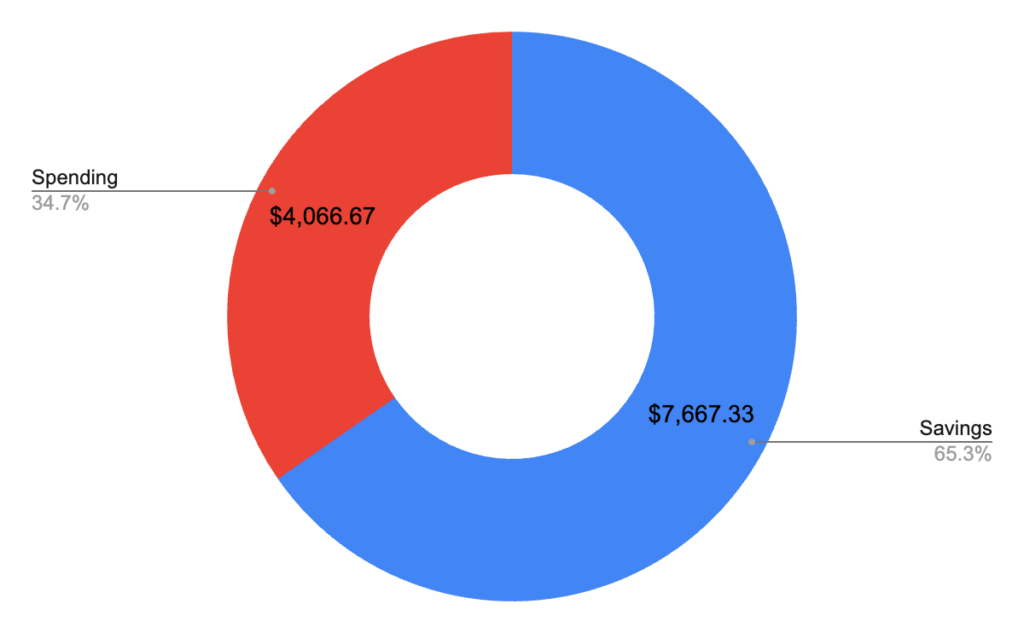

2018

This is already looking a lot better. I found out about FI over the summer of 2018, and started a bet with my friend to save up $10,000 by the following March. I managed to get my savings rate up to 65.3%:

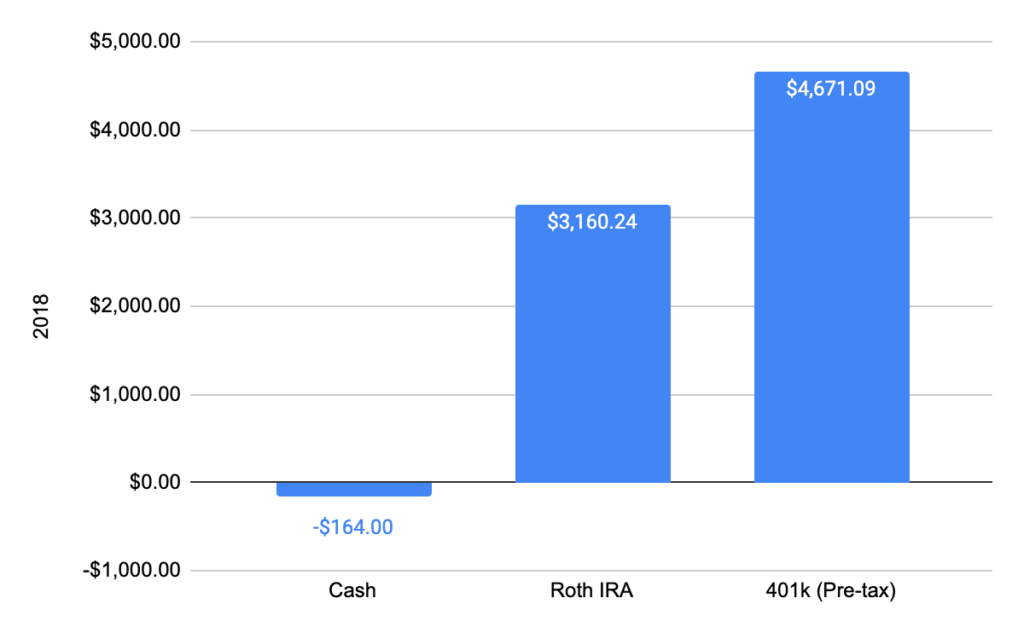

And I found the wonders of the 401k! My retail job let me open a 401k around the same time I got my internship where I could also have a 401k, and my savings looked like this accordingly:

2019

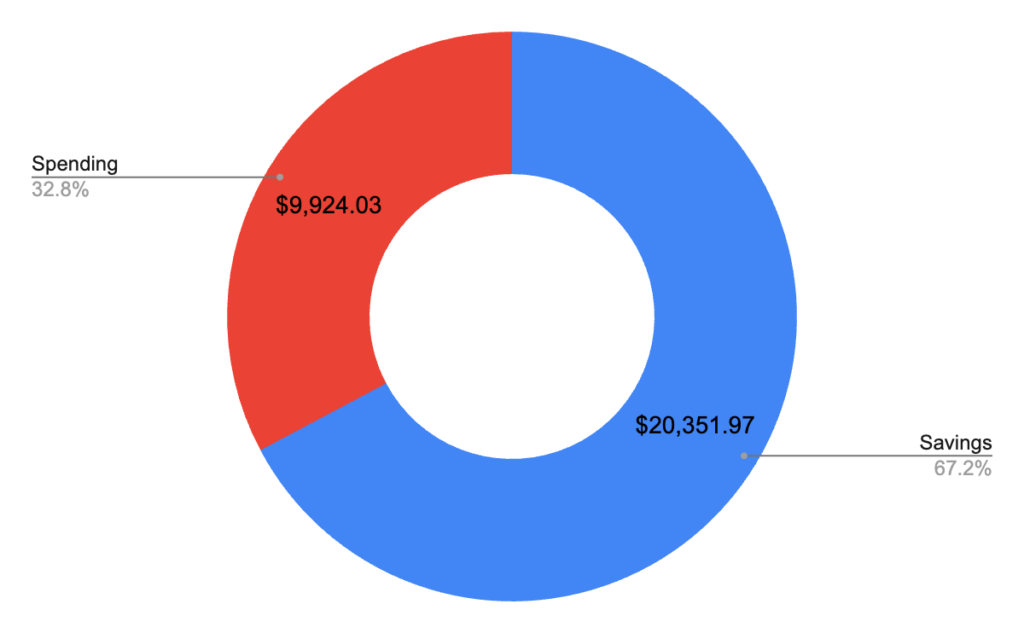

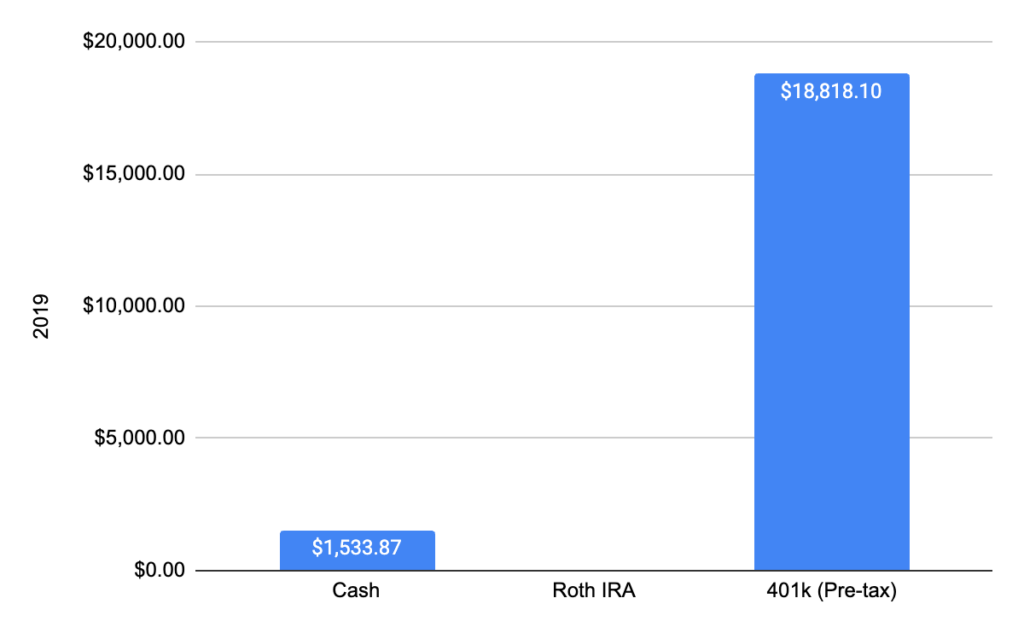

I kept the momentum going into 2019 and I had the $10k saved up by March. I worked a lot more hours at my internship, quit the retail job, and managed to graduate college early at the end of 2019. I decided I’d try to max out my 401k, and my savings rate increased to 67.2%:

And yep, I just about did it! I think I probably just miscalculated my withdrawals and that’s why I’m ~$180 short:

Of course, doing this meant forgoing Roth contributions, but thankfully there’s time in the following year to fix that!

2020

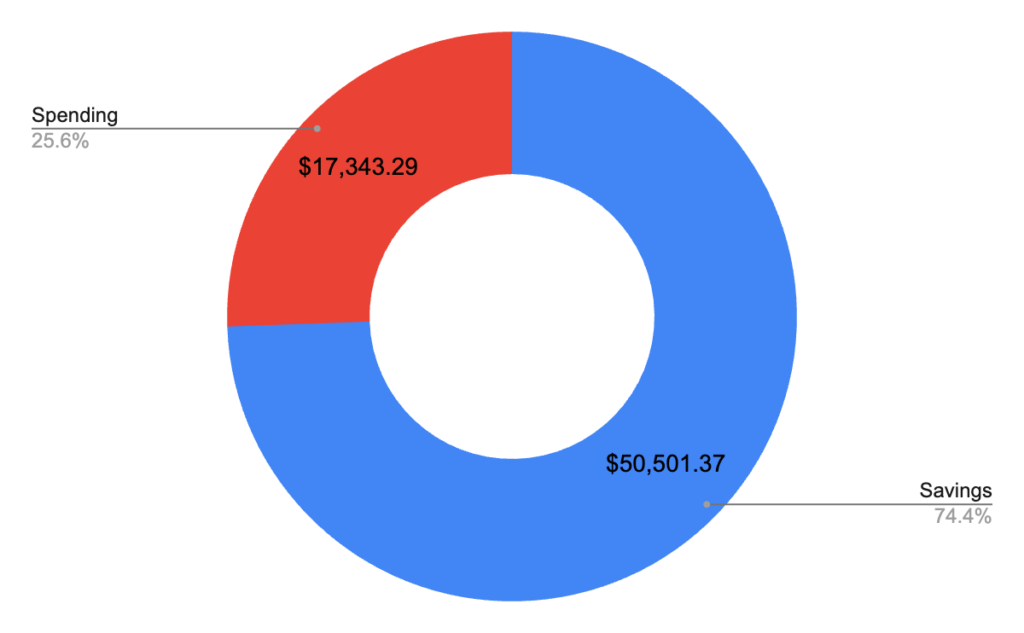

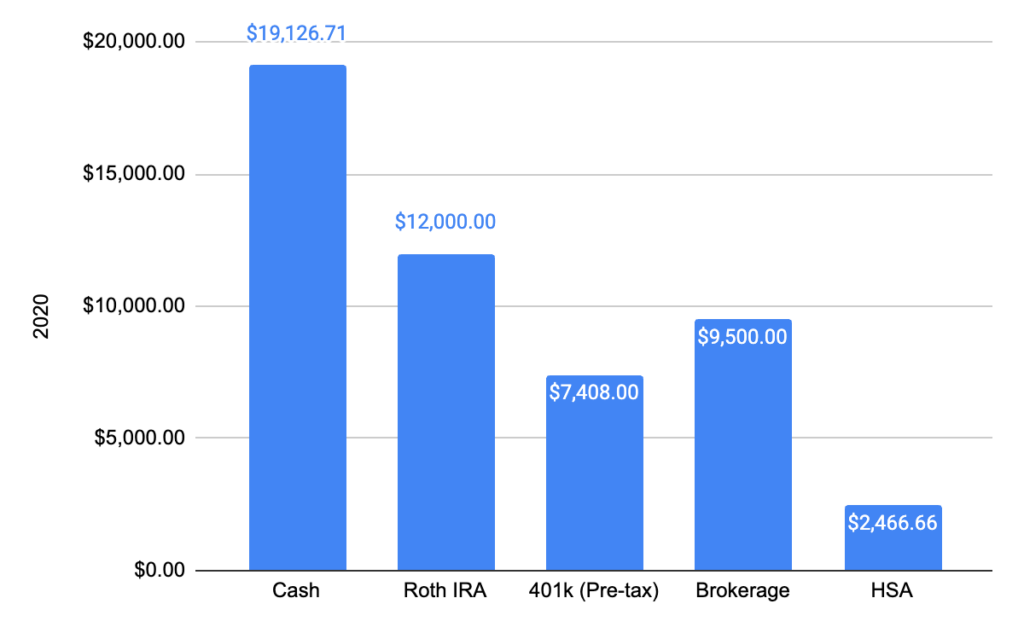

In 2020 I started my first full time job, got laid off, and got another full time job. I now had to pay for rent and groceries myself for the first time, since my scholarship had been generously providing me with room and board. Despite that, I managed to increase my savings rate again, to 74.4%:

I was able to contribute to 2019’s Roth IRA limit early in the year, but because my job after the layoff had a 6 month waiting period before starting a 401k, it stopped me from fully maxing it out. To compensate, I opened up a brokerage account, and held entirely too much cash for my needs in hindsight:

Saving 50k off of a net income of 68k is pretty damn good! This is definitely one of the years I’m most impressed by. Though, I’m sure being stuck inside most of the year definitely helped keep my spending down.

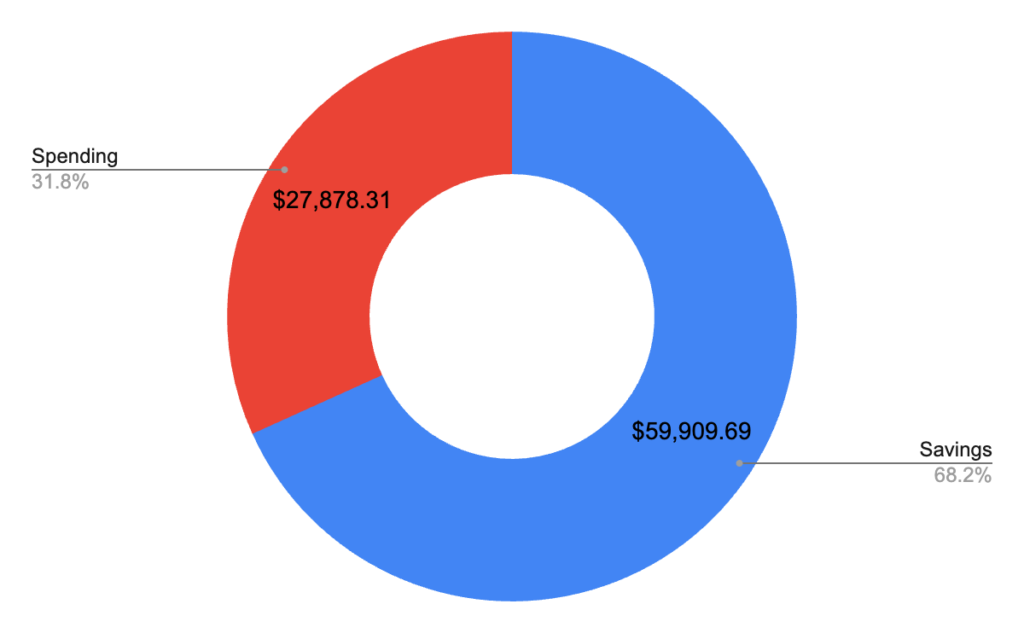

2021

The world started to reopen a little, I got a new job (with a raise) and another raise later in the year. I saved more money than in any previous year, at nearly $60k. However, my savings rate dropped slightly to 68.2%:

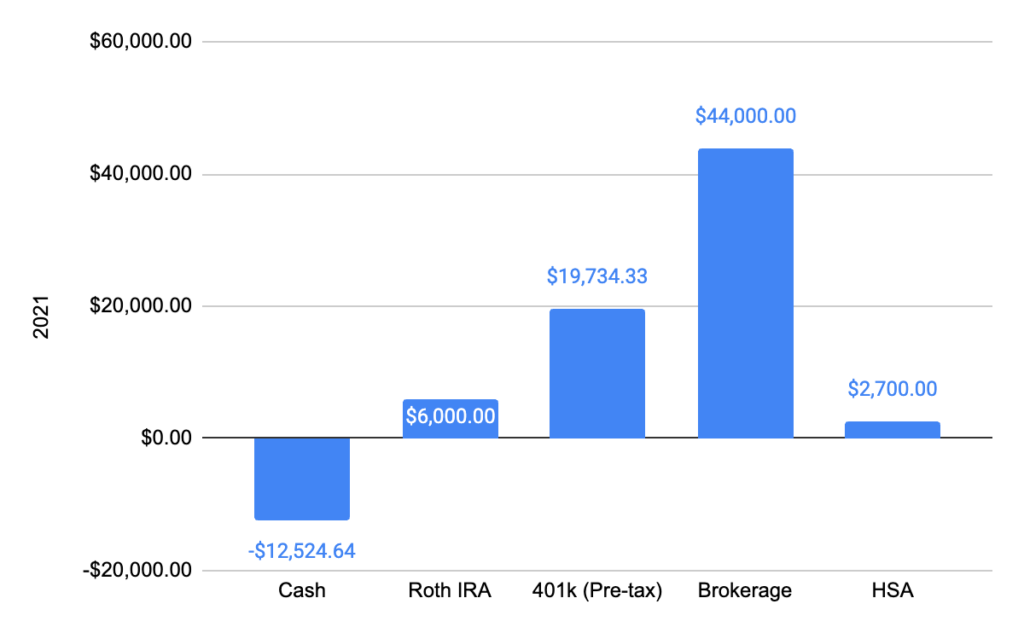

I was able to max out my 401k account (and by my math, I overfunded? I must’ve fixed that in 2020 but whatever) and contribute much more heavily to my brokerage account. This took a bite out of the cash reserves from 2020 to have more of my money working for me:

I sure hope there’s no bear market coming anytime soon to take a bite out of this!

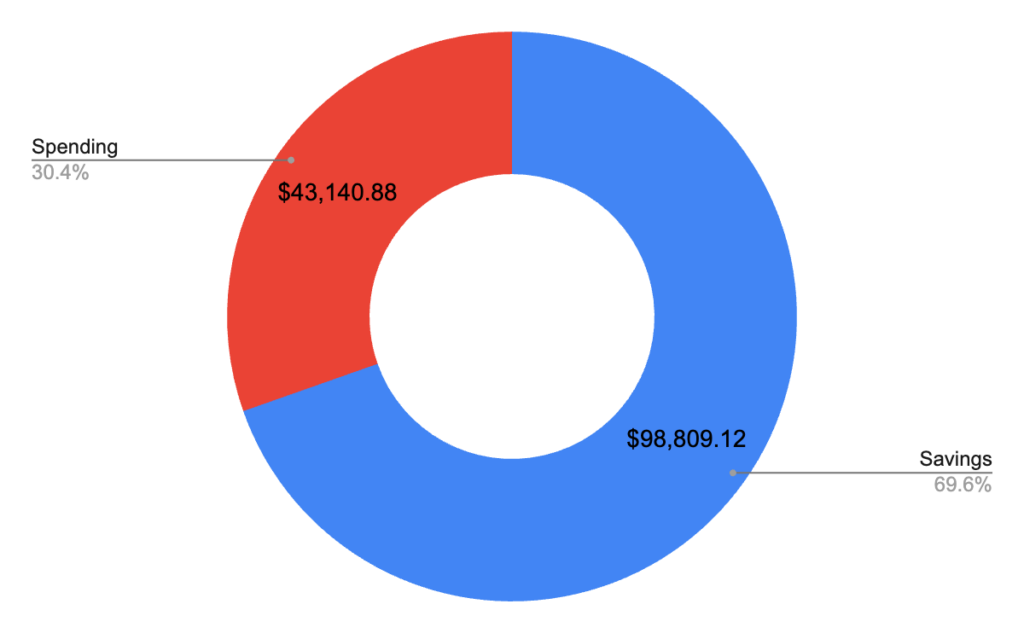

2022

Bear market time! This year saw me getting two promotions, each with a raise, a retention bonus payout, some vesting RSUs, and a cash bonus later in the year. I also finished grad school. I stopped watching what the stock market was doing (too painful) but didn’t stop investing. Even with increased spending, I was able to save almost $100k and increase my savings rate to 69.6%:

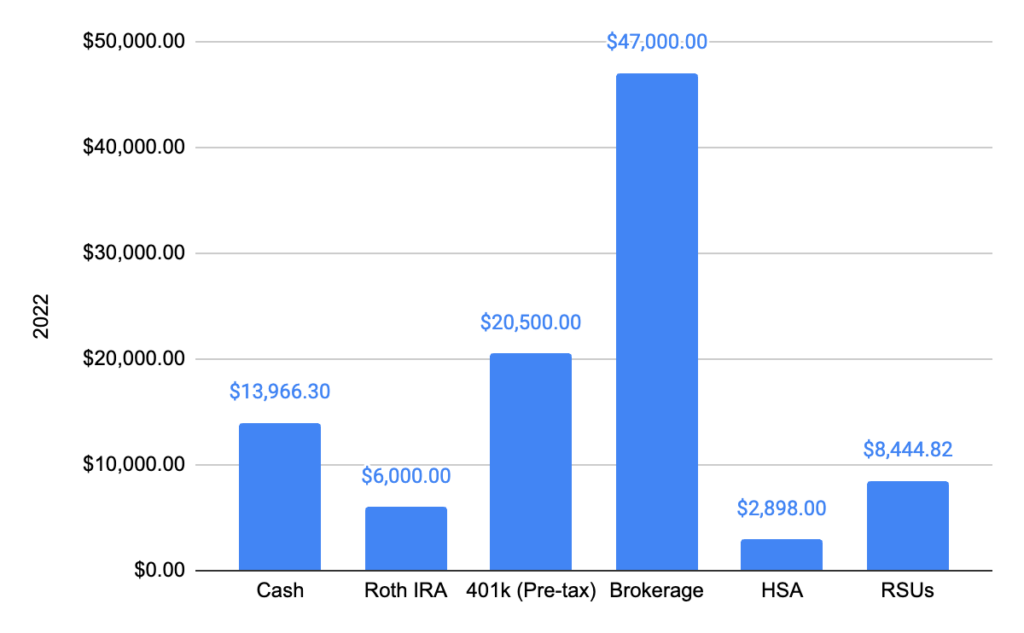

I put more into brokerage than ever before, maxed out the big three accounts, and even still had some extra cash to spare:

2023

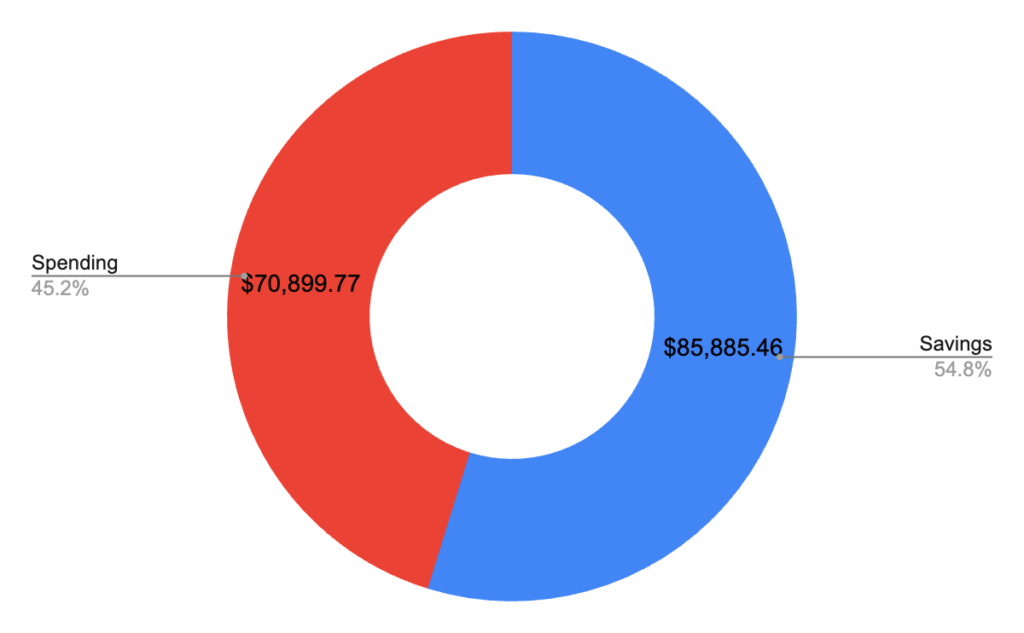

In 2023, I started the year by starting a new job, a new car, and meeting my now girlfriend in the span of one weekend. Life comes at you fast sometimes. I also spent way more money than ever before, at over $70k. Later in the year I picked up a second job (and a second car, but thankfully not a second girlfriend), which helped me salvage a 50%+ savings rate, at 54.8%:

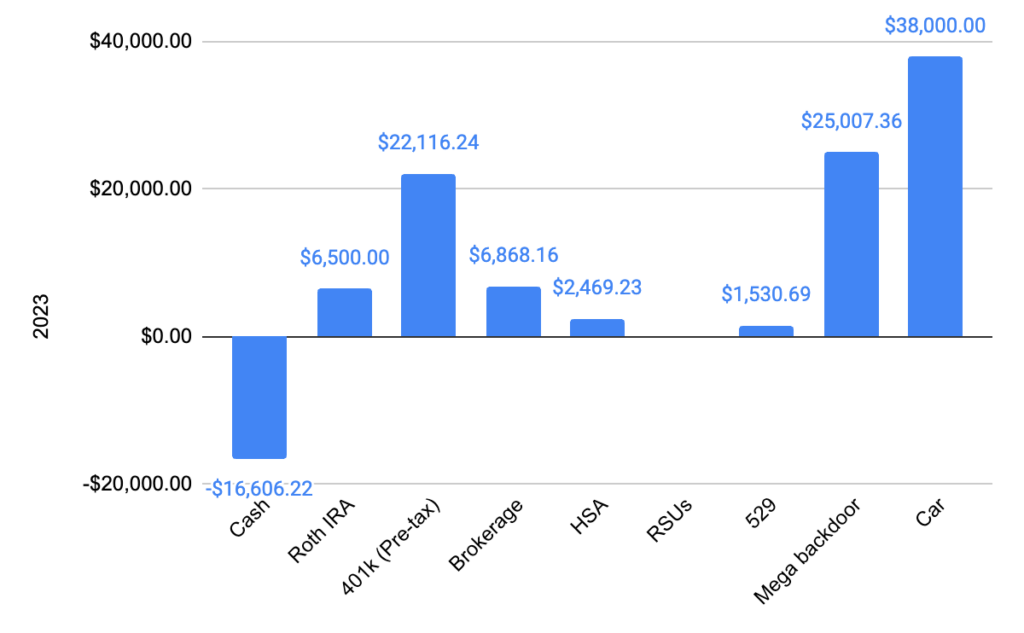

A lot happening here. While I didn’t count the first car as “savings” (since I sold it and it had no value at that point), I definitely did save for the second car, and it definitely still had a lot of value after I bought it, so I think I can count it as an asset for these purposes. I maxed out (or nearly, always hard to get it right when you switch jobs) the big three accounts, but had a really weak showing on brokerage contributions. I also got to contribute to a mega backdoor Roth IRA at my second job:

It’s hard not to wish I’d kept the same momentum with a 70% savings rate in 2023, or with more invested in brokerage, but I also had a lot of fun, so I can’t really be upset about it. Still having a 50% savings rate at the end of the day is pretty good.

Totals (2017 – 2023)

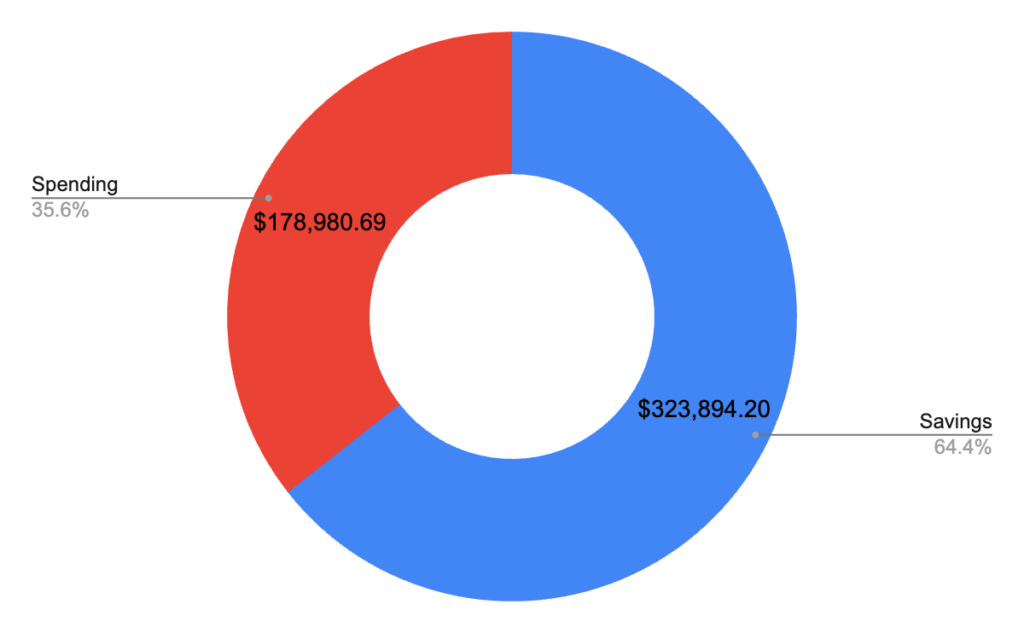

And finally, a look at everything from 2017 through 2023 added together. First savings rate, at 64.4%:

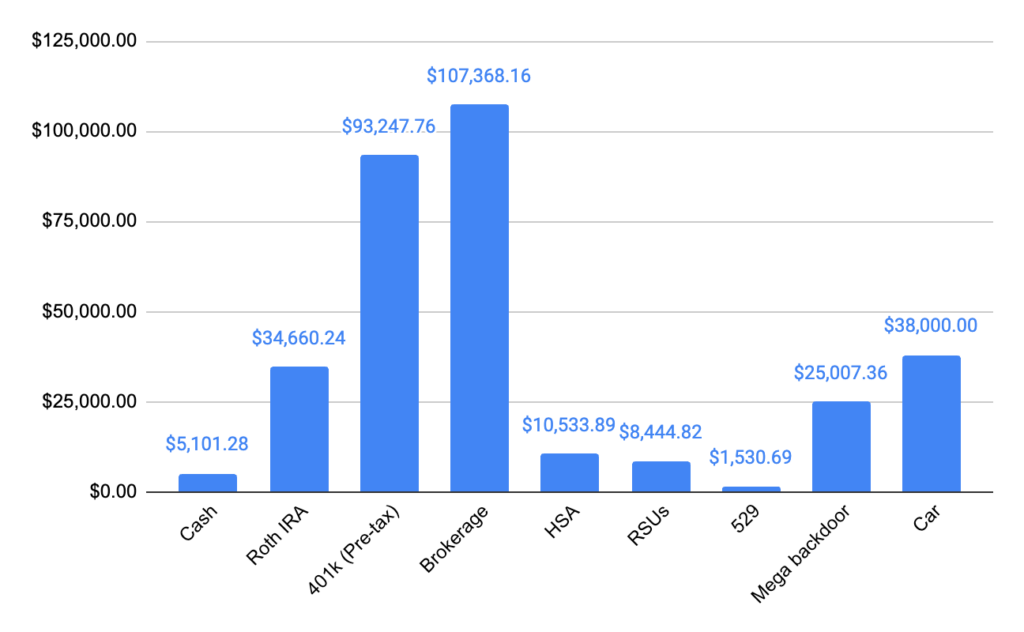

And then, savings broken down by type:

A look at savings by year:

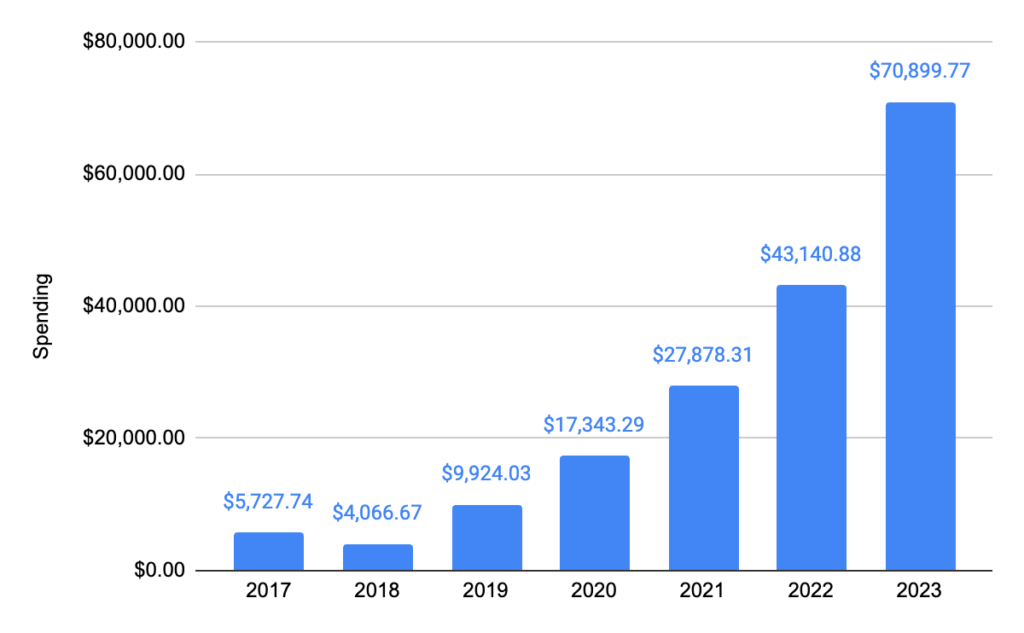

And spending by year, which shows a definite trend of spending more each year. Left unchecked, even if I save more, FI is still in the distance:

All around, pretty cool to get some concrete numbers on all this! I was never as good at keeping close track as I have been this year, but thankfully it was fairly easy to go back and get things figured out.

I’ll have a separate post early next year once 2024 is officially over going over all those numbers too. I have a good idea of what to expect but want to make sure it’s as accurate as possible, and with tracking my spending all year I’ll be a lot more confident that it is! Let’s just say I think things are moving in a much more positive direction all around. Thanks so much for reading and hope you enjoyed!

Leave a Reply