Hey folks! Where do I even begin with November? The stock market went on an absolute tear this month, with the S&P 500 increasing about 5.7%, adding to an already incredible year so far. The S&P 500 is now up 26.5% for the year, which is completely mind boggling. And then, as all that was happening, my second job laid me off! I wrote a whole blog post about it, which you can read here, but, long story short, I was really happy about it since I was given a great severance and was able to ease back to only working one job. I’ve been a lot happier and don’t have much of a desire to go back to trying to work two jobs at once. With that being said, without having done that, I would have never had such an incredible year financially, so I’ve got to take the good with the bad. With all that being said, let’s get into the numbers!

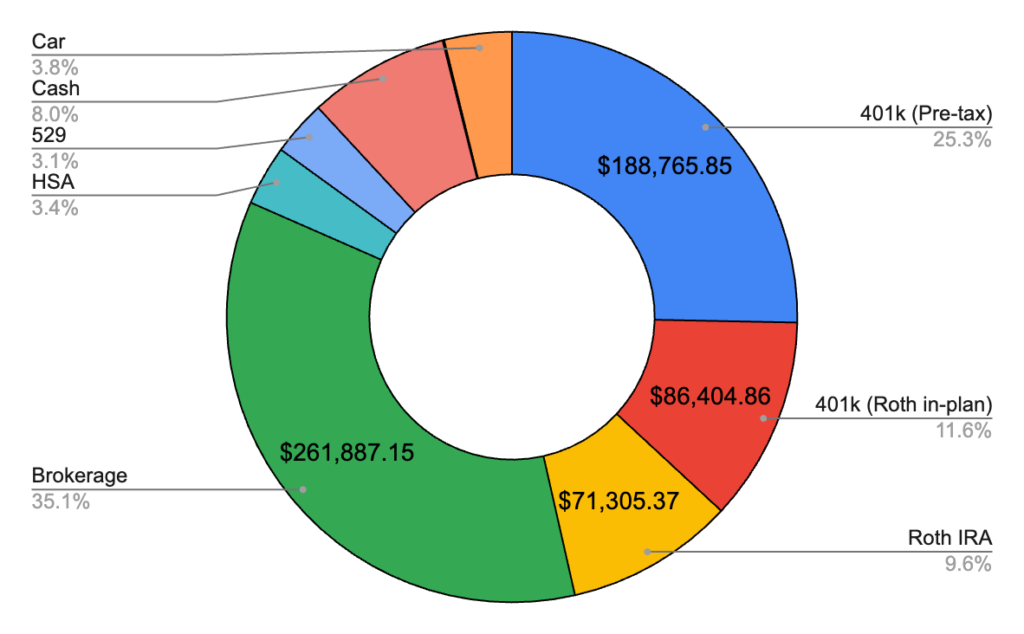

November 2024 – $732,379.62 (+$73,682.30)

Total Investment Contributions – $4,222

There’s nothing else I can really say besides: holy shit! I’ve never had a month even quite hit a 40k gain, and this month I blew past that, 50k, 60k and 70k to end up with a massive almost 74k gain. It’s an absolutely insane number to comprehend. Put differently, 10% of my entire net worth was made in the last 30 days. That’s completely insane. I’ll get into more details about what all went into that below, but it’s about 50-50 getting paid out some sweet sweet severance money alongside the amazing gains in the market. I did invest quite a bit less this month than any previous month all year, and I’ll get into that below more too. I took a similar approach to last month and stacked up some more cash since buying a house is very much still on the table soon. I’m also still heavily considering a sabbatical or just LeanFIRE-ing altogether in the near future, which I still need to find time to write about more. In either case, I don’t feel too bad about holding a near 10% of my NW in cash, which is still getting about 4% interest in a HYSA. Let’s get into the breakdown by account!

Brokerage – $261,887.15 (+$15,810.14)

Once again this month I contributed nothing. I got tempted to throw some in at the end of the month, and still might in December to round out the year. If I decide I don’t have an immediate use for all the cash I’m holding, this is where it’ll end up. Some major gains here helped by both the insane growth in the S&P 500 along with my company stock outperforming the market by a lot. Guess they’re good for something even though they laid me off!

401k Pre-Tax – $188,765.85 (+$7,264.07)

This month I contributed $2,034.51, plus a final employer contribution of $218.75. I also had to adjust to stop counting my unvested 401k match (which I never should’ve been counting in my net worth in the first place… my bad) since I was laid off. Still, the markets helped overcome even that $5k loss.

401k Roth In-Plan – $86,404.86 (+$6,821.93)

This month I contributed just $2,187.51, and that’s the end of my contributions here! The rest is all just amazing gains. I’ll really miss the mega backdoor Roth IRA, but I’m glad I was able to get this much contributed before losing my chance to do more.

Roth IRA – $71,305.37 (+$3,950.65)

Pretty incredible gains here for the month, and I’m getting ready to contribute here again soon come January!

Cash – $59,465.39 (+$48,893.18)

And here’s the big one! As part of getting laid off, the $7k I’d saved up towards my next ESPP purchase came out to me in cash. I had one last check from my second job, and then my usual two checks from the first job, with just slightly more coming out for 401k so I can hit the annual limit. The biggest contributor was my severance check, which was about $44k gross. That was about three months worth of salary, so it’s kinda like getting paid for the rest of November, December, January, and half of February all at once. The IRS under-withheld federal taxes at 22% instead of the 35% they should’ve taken, but I’ll go ahead and hold onto that for now and give it back in April. They’ve taken extra Social Security (since they held the yearly max at each job) so we’ll see how things wash out once I file taxes. Best layoff ever!

Car – $28,536.00 (-$2,515.00)

A very sizable drop here, and I’m not exactly sure why. That being said, I see similar used Teslas selling for about the new KBB value, so it probably lines up with reality a little better.

HSA – $25,405.92 (+$1,433.30)

With getting laid off, only my employer contributed a total $125 this month, and the rest was all gains.

529 – $23,376.48 (+$1,294.31)

I contributed nothing to my 529s this month. My philosophy on 529s changed a little bit in the last month, as I considered the penalties for withdrawing for anything other than school related expenses. If I’m going to be living on a modest income like I plan to, I can withdraw anything I need from a brokerage account and pay 0% capital gains, so why keep this money off to the side for no real benefit? I’ll still have the money for my future kids one way or another, and depending on how I do it, there’s ways to tax optimize to help make college more affordable. I won’t bother unwinding these until I’m in a lower tax bracket, even though this is mostly contributions rather than gains.

Precious Metals – $559.80 (-$30.60)

I guess silver had a bit of a drop this month!

Bonds – $112.80 (+$0.36)

The sweetest 36 cents I earned all month.

ESPP – $0.00 (-$7,000.04)

Goodbye ESPP!

Federal Taxes Owed – -$13,440.00

The government gave me too much money over the year, so in December 2024 I went back to try to distribute what I owed evenly over these reports.

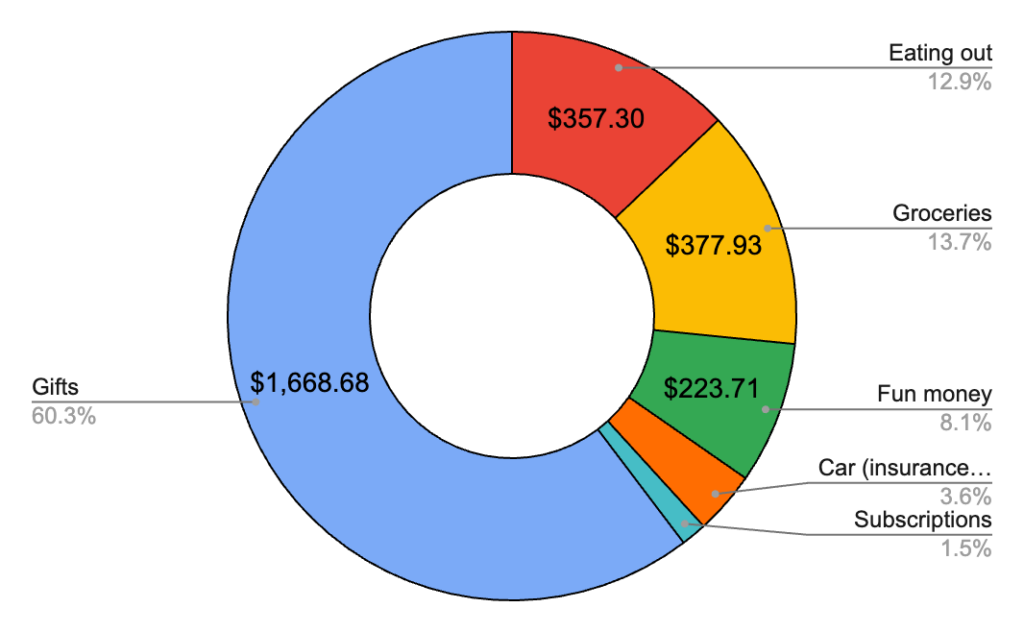

November 2024 Total Spending – $2,766.74

November was a month spent at home with family, which meant no rent for us! Next month we’ll be getting out of town, and so that expense will return, but it was a nice break! All my medical stuff wrapped up nicely this month and so I don’t have to keep bouncing back here for appointments. Still no new medical bills either, which is a blessing. Spending was overall down this month, but let’s get into the categories!

Gifts – $1,668.68

It’s almost Christmas time! I got most of my shopping done this month and even gave a couple early gifts for fun! There might be some small spending here next month but this should be the bulk of it!

Groceries – $377.93

It was a bit more expensive month for groceries, but we were definitely cooking at home a lot more than the last couple months! Will likely be similar next month.

Eating out – $357.30

That’s a lot better! After a couple months near $800, I’ll take a good $500 improvement! We got drinks with friends a time or two, some meals out on one trip we took, along with some other meals here and there. Next month should look pretty similar.

Fun money – $223.71

An escape room, a hotel stay, a trip to the casino (that’s $100 of it, damn you roulette), and some other odds and ends. Pretty usual month.

Car expenses – $98.90

A much slower month for us, and the ability to charge my car at my mom’s house helped keep expenses down here too! This was mostly just insurance.

Subscriptions – $40.22

Just the usual here, gym being the biggest expense.

November 2024 Savings Rate – 94.0%

As always, I calculate my savings rate based off how much I save AFTER taxes are taken out. So this month that math was 2,766.74 / 46,419.09. That means my spending rate was 6.0%, and conversely, my savings rate was 94.0%. Has to be the all time high for me, helped by both a way above average income month, but a somewhat below spending month as well! I’m not sure I’ll ever see a savings rate this high again!

Next month, back on only one income, I should be somewhere between a high 70s or low 80s savings rate! I’ll also have a more in depth look at reviewing my whole year in finances, which I’m also looking forward to! December is going to be a fairly relaxing month, with family later in the month. And having just one job now feels like a constant vacation for me. Hope everyone’s holidays are going well! Thanks for reading!

Leave a Reply