Hey folks! October was pretty good for the stock market, at least for the first half of the month. There were a couple new all time highs for the S&P 500, and even after some small drops, the market was set to be up about 1% on October 30th. And then on the last day of the month, we saw a nearly 2% drop (caused by some tech earnings reported the day before), leaving the market down 0.99% for the month (and me seeing a more than 10k loss in a single day!). So that’s the first down month we’ve seen since April! Definitely can’t expect them all to be winners! Let’s get into the numbers!

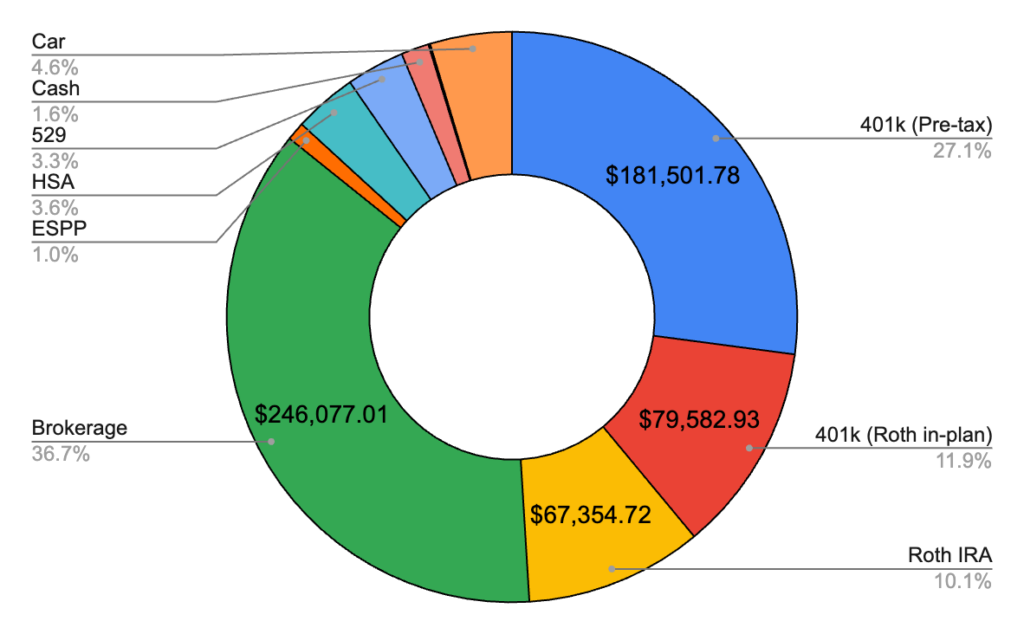

October 2024 – $658,697.32 (+$11,282.10)

Total Investment Contributions – $10,463

A much more modest gain this month compared to the last several! I also ended up scaling back my investment contributions a bit more to start piling up some cash, which I’ll explain more below. I still am hoping to hit $700k by the end of the year, and I think it should happen as long as there’s no major drops in the market. I’m also starting to formulate a plan to quit my jobs (but not until next year!), which I’m sure I’ll write more about soon. Let’s get into the breakdown by account!

Brokerage – $246,077.01 (-$3,052.11)

This month I contributed absolutely nothing, for the first time in a long time! I decided to just hold onto anything I would’ve invested in cash, and keep all the rest of my contributions the same. As a result, this dropped along with the market. My small bit of company stock continues to disappoint, underperforming the market by a lot. Hopefully that changes sometime before I can sell it!

401k Pre-Tax – $181,501.78 (+$713.37)

This month I contributed $1,917.00, plus an employer contribution of $437.50, which was just enough to have a gain here with the market losses!

401k Roth In-Plan – $79,582.93 (+$3,653.25)

This month I contributed the usual $4,375.00. Should get pretty close to $90k by the end of the year!

Roth IRA – $67,354.72 (-$613.86)

Some loss here from the market, and obviously no contributions, but January is approaching!

Car – $31,051.00 (-$1,240.00)

A bigger drop here, but after the weird gain a couple months ago I’m not that surprised.

HSA – $23,972.62 (+$140.31)

I contributed $345.84, between me and my two employers!

529 – $22,082.17 (+$2,027.14)

This month I contributed $2,250 as usual!

Cash – $10,572.21 (+$9,035.78)

Here’s the major gain for the month! And why start piling up so much cash? Well I’m seriously looking at buying a house in the next six months, and I figured if I divert the money I would usually throw into brokerage I can save up a down payment without having to sell anything. My HYSA is still at about 4% interest for now, but I know that’ll go down soon if rates keep getting cut. Either way, I don’t see a huge point in buying more stock only to have to sell it. I’m also starting to plot my off ramp from my jobs, so I want some cash saved up for living expenses as well. So expect to see this grow in the coming months!

ESPP – $7,000.04 (+$1,750.00)

Two more months to the next purchase! Would love to see the stock improve soon since I’ll have some RSUs vesting before too long, and I plan to sell immediately!

Precious Metals – $590.40 (+$24.84)

I guess silver did pretty well this month!

Bonds – $112.44 (+$0.08)

The interest is really picking up on this one!

Federal Taxes Owed – -$11,200.00

The government gave me too much money over the year, so in December 2024 I went back to try to distribute what I owed evenly over these reports.

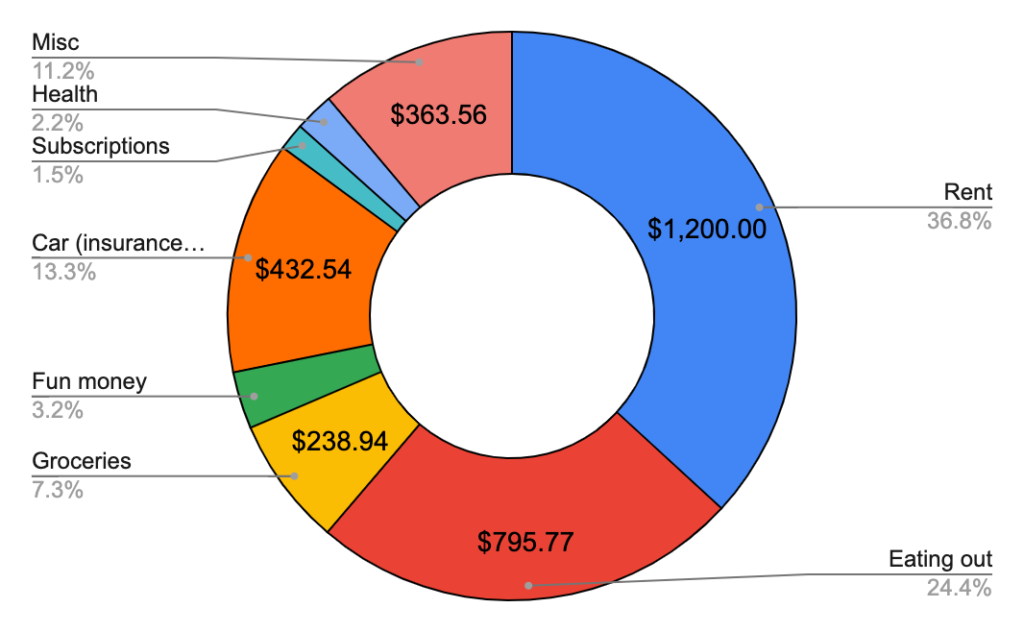

October 2024 Total Spending – $3,259.00

October was another month with lots of traveling for appointments and such. Somehow I ended up with basically no medical bills this month, and it almost looks like one I already paid might end up getting refunded to me. Insurance makes no sense sometimes, especially when you’re doubly insured! But I’ll take it!

Rent – $1,200.00

Another month of paying some rent! Next month we’ll be with family, and we’ll see what we end up doing in December, but sometime early next year we’ll have to move for my girlfriend’s job, and the rent payments will be back!

Eating out – $795.77

Well I guess this was technically an improvement from last month but sheesh! We had plenty of good meals out, and I had more Chipotle and Taco Bell than I’d care to admit. In November we’re committing to do a lot better (mostly for health reasons) but that should also help to bring this down.

Car expenses – $432.54

Did plenty of driving this month, so that brought my costs up. Otherwise just the usual insurance and parking and such!

Misc expenses – $363.56

Once again, the vast majority of this is another credit card annual fee, this time for an AMEX gold card. I just wrapped up getting my sign up bonus for my second card, so this’ll be my third. I randomly got a signup bonus for 100k points after a certain amount of spend, so I decided it could be my next card to work on. This category should be much lower next month.

Groceries – $238.94

Pretty normal numbers here! Expecting similar in the next couple months.

Fun money – $105.85

Some mini golf, a hotel stay, and some other random things. Might be higher next month since we’re doing some more traveling, but we’ll see!

Health – $72.58

Amazingly almost no medical bills this month, and it looks like I shouldn’t have much more coming my way, so I’m happy about that!

Subscriptions – $49.76

The usual gym membership and a few other things in here!

October 2024 Savings Rate – 84.9%

As always, I calculate my savings rate based off how much I save AFTER taxes are taken out. So this month that math was 3,259.00 / 21,622.02. That means my spending rate was 15.1%, and conversely, my savings rate was 84.9%. Back where I wanted to be!

Next month I should finally get back above 90%, since there won’t be rent to pay. We’ll see what happens! Thanks for reading!