Hey folks! September really did start a whole lot like August, seeing an over 4% drop in the S&P 500, before things turned around a week later with gains for nearly the rest of the month. The Fed cut rates by a 50 basis points, and the market reacted pretty favorably to that news. September ended up 2.02%, with the S&P 500 at an all time closing high, and broke a streak of September always being a losing month for the last several years. All around, it was a good month! Let’s get into the numbers!

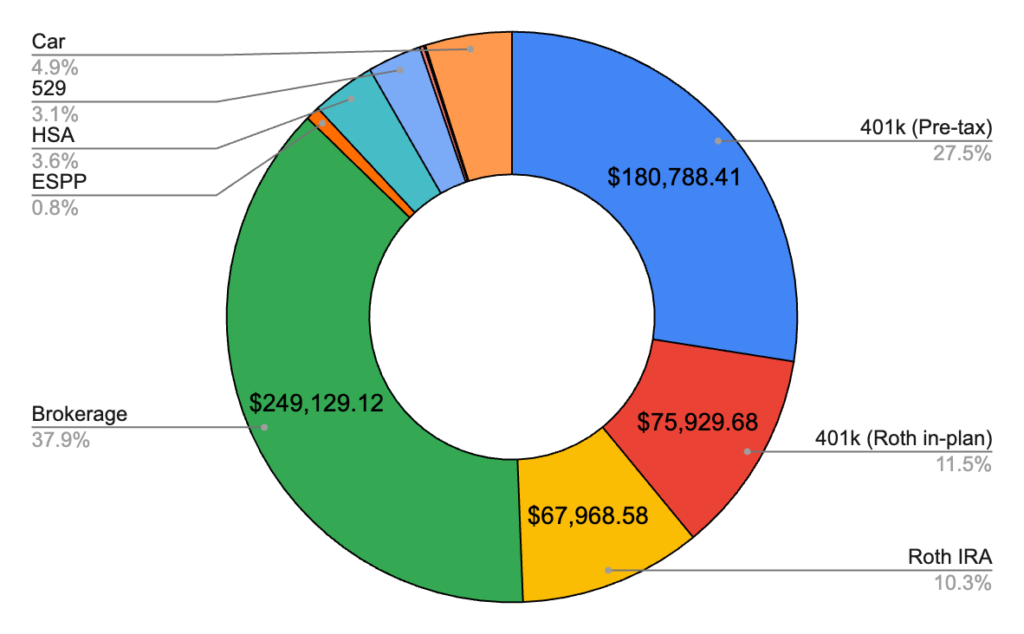

Sep. 2024 – $647,415.22 (+$28,229.43)

Total Investment Contributions – $14,393

Yet another nearly 30k gain this month! I did scale back on my investment contributions just a little bit to both shore up cash pay off the medical bills from last month that I put on credit cards for the points. I need to settle into a new investment amount for October, since I’m now paying rent again and I can’t just save almost every dollar I make. I’ll probably just go back to targeting $19.5k like I did the first half of the year. It almost looks like I could hit $700k net worth by the end of November now, even if the market would just stay flat. Let’s get into the breakdown by account!

Brokerage – $249,129.12 (+$7,965.18)

This month I contributed just $3,930.74, quite a bit less than usual. As I mentioned above, this was to pay off medical bills I had on credit cards from last month, and also to shore up just a little bit of cash since I had drawn it down a bit too low. Next month I’ll push the contribution back up quite a bit, and hopefully we’ll get to 250k in here!

401k Pre-Tax – $180,788.41 (+$6,062.57)

This month I contributed $1,917.00, plus an employer contribution of $437.50. Not much else to say here!

401k Roth In-Plan – $75,929.68 (+$5,941.97)

This month I contributed the usual $4,375.00. It’s really starting to pull away from my Roth IRA balance now!

Roth IRA – $67,968.58 (+$1,418.77)

Just growth here! Only a few months to January!

Car – $32,291.00 (-$155.00)

A small, expected, drop in value here.

HSA – $23,832.31 (+$796.59)

I contributed $345.84, between me and my two employers!

529 – $20,055.03 (+$2,630.55)

This month I contributed $2,250 as usual, but all at the end of the month instead of splitting between mid-month and end of month. I’ll go back to splitting next month, but needed the cash mid-month for the stuff I mentioned above!

ESPP – $5,250.04 (+$1,750.01)

Halfway to the next purchase now! The stock continues to disappoint me, but it could turnaround at any time.

Cash – $1,536.43 (+$2,890.60)

And here’s why I had to invest a little less! I have a bit more cash saved up, and will try to keep it about this level in the coming months.

Precious Metals – $565.56 (+$39.06)

A decent gain for my 18 oz of silver this month!

Bonds – $112.36 (+$0.36)

The interest is really picking up on this one!

Federal Taxes Owed – -$10,080.00

The government gave me too much money over the year, so in December 2024 I went back to try to distribute what I owed evenly over these reports.

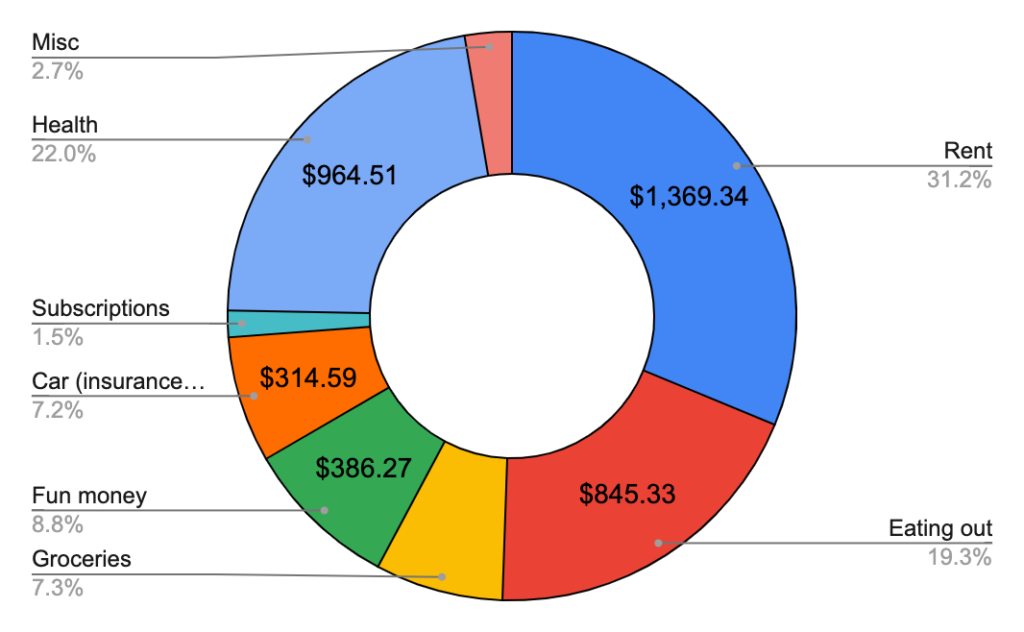

Sep. 2024 Total Spending – $4,382.57

September was a busy month, and I’m definitely feeling a lot better with time. I had just a couple follow ups, and the medical bills are trickling in slowly. There really shouldn’t be too much left, but we’ll see! I also moved back in with my girlfriend now that her job training is done, meaning the dreaded rent payment returns to the balance sheet. It’s really more of a temporary living arrangement than actual rent, but we’ll just keep it simple! There’s likely to be more movement and changes in the coming months, but hopefully all will settle down before long!

Rent – $1,369.34

I did not miss paying for this! At least we were able to find some cheap temporary housing in a decent location! I expect this to decline in the coming months since we’ll be spending more time around family over the holidays and won’t need to be booking a place to stay!

Health – $964.51

More bills! And more to come! But hopefully only a couple thousand more at most!

Eating out – $845.33

Oh damn, that was more than I expected. I guess we did do some traveling, and I did order in food more than usual. Definitely a good time, but I’ll look to reign this in a little next month.

Fun money – $386.27

A video game or two, a weekend trip out of town, and some pottery painting, along with some other random things!

Groceries – $318.89

A pretty normal month now that we’re back in the swing of things. Hopefully stays about here next month.

Car expenses – $314.59

Insurance, car charging and tolls, the usual! Looking forward to the day I can charge the car at home!

Misc expenses – $117.37

Biggest thing here was the annual fee for a credit card I opened, since I’m newly playing the sign up bonus game (might as well get something for all those medical bills)!

Subscriptions – $66.27

My gym membership and a few other odds and ends here!

September 2024 Savings Rate – 78.8%

As always, I calculate my savings rate based off how much I save AFTER taxes are taken out. So this month that math was 4,382.57 / 20,622.02. That means my spending rate was 21.2%, and conversely, my savings rate was 78.8%. Pretty similar to last month, and hopefully on an upward trend!

Honestly next month will probably be close to the same, since those last medical bills are likely on their way! We’ll see if we can at least get closer to 85%! Thanks for reading!